[ad_1]

Josh Martin

Everybody likes a bonus – be it a bonus in pay, or a bonus episode in your favorite TV present. Everybody, that’s, besides statisticians. Bonuses are onerous to outline and measure and are sometimes excluded from information on pay. However bonuses could possibly be actually vital to know labour market tightness – a subject of a lot curiosity in the intervening time. This weblog takes a fast stroll by way of some pay measures, highlighting the position of bonuses, and exploring what has occurred to bonuses earlier than, throughout and because the pandemic.

A steadily used measure of pay by the Financial institution of England is Common Weekly Earnings (AWE) common pay for the non-public sector, revealed by the Workplace for Nationwide Statistics (ONS). AWE statistics can be found for a lot of industries and sectors, and with varied inclusions and exclusions. ‘Common pay’ statistics exclude bonuses and arrears (comparable to extra time).

Specializing in common pay permits us to extra clearly see the development, because it avoids affect from typically unstable elements of whole pay. Which means common pay might be extra applicable as a measure of inflationary strain over the medium time period. Nonetheless, because it omits bonuses, it could not absolutely replicate wage dynamics over the enterprise cycle.

Companies seem like utilizing bonuses to draw or retain expertise in at the moment’s tight labour market, permitting them to compete for expertise with out locking themselves into increased everlasting salaries. As such, focusing solely on common pay (which excludes bonuses) could understate present pay strain. Bonuses can also have a ‘particular standing’ with workers – they could be seen extra immediately as a ‘reward’ and due to this fact elicit effort in reciprocation (as an illustration, see Hossain and Checklist (2012) for a behavioural economics view).

To see if bonuses assist us perceive labour market tightness, Chart 1 exhibits a easy wage-Phillips curve, with the short-term unemployment price (a easy measure of extra unemployment) on the x-axis, and rolling-annual progress of nominal pay on the y-axis. Orange circles use ‘common pay’, and blue circles use ‘whole pay’ (together with bonuses) – each from AWE. The slope of this straightforward wage-Phillips curve is steeper with whole pay than with common pay (though the match is a bit of worse). That means that the wage response to labour market tightness (measured by the short-term unemployment price) is extra pronounced when together with bonuses, than when excluding them.

Chart 1: Easy wage-Philips curves, short-term unemployment with common and whole pay, 2001 Q1 to 2019 This fall

Notes: Brief-term unemployment refers to lower than 12 months in period. The development line remains to be steeper for whole pay if utilizing different x-axis variables, together with unemployment hole measures, adjusting for costs or productiveness, and after excluding the outlier in blue (2009 Q1). I’ve not examined for significance of distinction. I exploit a quite simple scatter plot of short-term unemployment and wage progress for ease of visualisation, however extra refined fashions can have superior predictive and explanatory energy. For extra, see August 2013 Inflation Report, Weale (2014) and Cunliffe (2017).

Supply: Creator’s calculations utilizing ONS Common Weekly Earnings and unemployment information.

What information is there on bonuses?

Bonuses are onerous to outline and measure, owing to their irregularity, seasonality, and selection. Bonuses might be particular person, team-based, organisation-wide, performance-related, contractual, discretionary, hiring bonuses, retirement bonuses, and extra in addition to. At my final job, some bonuses had been paid through procuring vouchers!

As a result of bonuses are heterogeneous, information on them is sort of restricted. Common Weekly Earnings (AWE) from ONS identifies some bonuses however not all. The bonus query on the Month-to-month Wages and Salaries Survey (the survey that collects the information for AWE), asks respondents about ‘bonuses, commissions or annual revenue from revenue associated pay schemes’.

This explicitly excludes signing-on bonuses, or ‘golden hellos’ as they’re generally referred to as. In a decent labour market like at the moment’s, these signing-on bonuses could be particularly vital.

Bonuses are extremely seasonal – they are typically highest in March, and are elevated in December, January and February – reflecting typical fee on the finish of the calendar and monetary years. That makes seasonal adjustment particularly vital. A technique round that is to match the identical month or quarter between years (eg utilizing 12-month progress charges), since they are going to be affected by seasonality to the same diploma.

A lately launched ONS information sequence – Common Labour Compensation per Hour labored (ALCH) – captures all labour compensation, in step with Nationwide Accounts definitions. It will embrace wages and salaries in money and in form (eg firm vehicles), bonuses (together with all the kinds listed beforehand), extra time pay, sick pay, maternity and paternity pay, and non-wage labour prices comparable to employer pension and Nationwide Insurance coverage contributions. ALCH additionally accounts for self-employment labour revenue (taken as a share of combined revenue). This could give us a greater learn on whole pay than AWE, however bonuses can’t be separated out right here. It is usually much less well timed than AWE, as it’s quarterly moderately than month-to-month, and produced with a lag. Trade breakdowns are obtainable, alongside information on Unit Labour Prices and the labour share of revenue.

Exterior pay indicators, comparable to these from the REC Report on Jobs, often don’t explicitly embrace bonuses. The Financial institution’s Brokers supply invaluable qualitative data – as an illustration, they famous a rise in ‘one-off retention bonuses’ of their 2021 This fall Abstract, and ‘one-off bonuses to compensate staff for increased inflation and to retain workers’ of their 2022 Q2 Abstract. However for quantitative measures on bonuses, AWE seems to be the most effective supply for now.

Which industries pay bonuses?

The finance and insurance coverage business may need a fame for large bonuses, however shouldn’t be the one business that pays them. Chart 2 exhibits business contributions to common (weekly) bonuses throughout the entire financial system, for Quarter 1 of every 12 months (when most bonuses are paid). The finance and insurance coverage business (mild blue bars) accounted for about 40% in 2021 Q1, down from nearly half over the previous decade, and about two thirds simply earlier than the monetary disaster. There are additionally comparatively giant contributions from enterprise companies industries (skilled and admin companies), the retail and wholesale business (partly reflecting its giant measurement), and the ICT companies business. The manufacturing business and different industries usually account for a fairly small share of whole bonuses.

Chart 2: Trade contributions to common weekly bonuses, quarter 1 of every 12 months

Notes: SIC 2007 sections of business teams are: Finance, insurance coverage = Ok; Enterprise companies = MN; retail, wholesale = G, ICT companies = J; Manufacturing = C; Different industries = all others.

Supply: Creator’s calculations utilizing ONS Common Weekly Earnings information.

What do the newest information on bonuses inform us?

Bonuses have grown way over common pay because the begin of the pandemic. Chart 3 exhibits traits in AWE common pay and AWE bonuses for the non-public sector since 2019. By July 2022, the newest information, bonuses had grown by about 40% on 2019 ranges, in comparison with 14% for normal pay. Many of the progress in bonuses got here throughout 2021.

The bonus information generally is a little unstable given smaller numbers, however the variation additionally displays financial circumstances – bonuses fell a lot additional than common pay in the course of the first nationwide lockdown, earlier than recovering extra sharply; and bonuses took an additional hit with the nationwide lockdown in early 2021 earlier than rebounding.

Chart 3: Common pay and bonuses, non-public sector, seasonally adjusted, index 2019 = 100

Supply: Creator’s calculations utilizing ONS Common Weekly Earnings information.

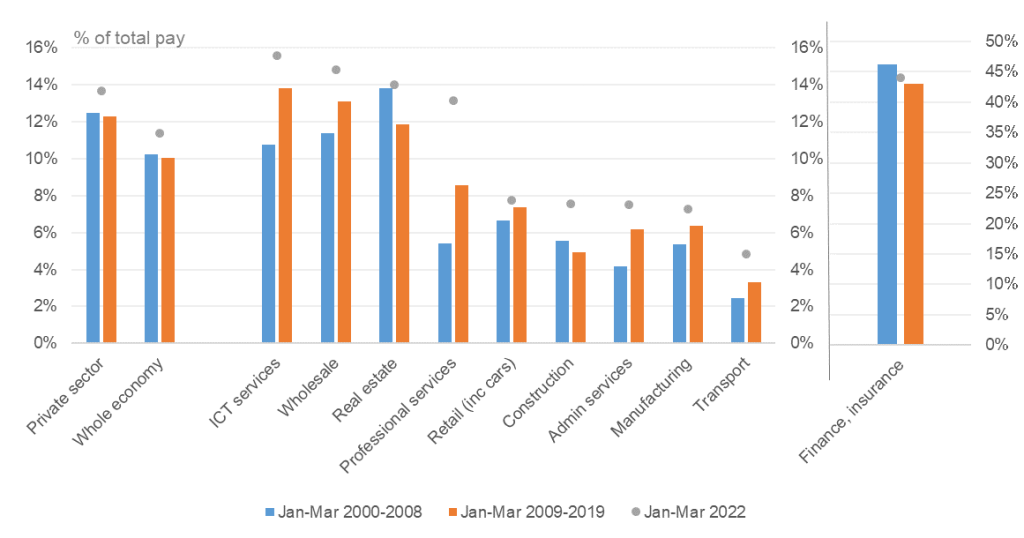

Given the expansion of bonuses over the previous 12 months, they now account for a bigger share of whole pay than common. Chart 4 exhibits the proportion of whole pay accounted for by bonuses within the first quarter of the 12 months, over completely different time intervals. The finance business is on a separate scale to the suitable hand aspect, because the figures are a lot bigger than the remainder of the financial system.

In most industries, bonuses at present account for a a lot bigger share of whole pay than common. The chart splits the interval into earlier than and after the monetary disaster, as a result of bonuses within the finance and actual property industries had been even increased earlier than the monetary disaster, and took successful afterwards. The present share of bonuses in whole pay is above pre-financial disaster and post-financial disaster ranges in most industries (though in finance it isn’t fairly at pre-financial disaster ranges).

The present bonus share is especially excessive relative to pre-pandemic ranges in skilled companies (consists of authorized and consulting), administrative companies (consists of employment businesses), transport and storage, and building. That is line with anecdotal experiences of marked competitors for expertise in these industries.

Chart 4: Bonuses as a share of whole pay, January–March over completely different intervals, not seasonally adjusted, chosen industries and sectors

Supply: Creator’s calculations utilizing ONS Common Weekly Earnings information.

The place subsequent for bonuses?

So bonuses are an typically ignored, and probably vital, a part of the entire pay packet. Nonetheless, bonuses are usually one-off in nature: they aren’t often embedded into wage progress and employment contracts. Which means companies may be capable to keep away from paying excessive bonuses once more subsequent 12 months if the labour market cools down, in contrast to will increase in common pay. That will often make bonuses much less immediately related to financial coverage makers centered on medium time period inflationary strain.

This 12 months, nonetheless, bonuses seem like completely different – not used only for efficiency (as captured in AWE), but in addition for retention and recruitment, and in response to ‘price of dwelling’ will increase. That may make them extra persistent, however it’s too early to know. Within the meantime, bonuses supply one other invaluable technique to assess the diploma of labour market, tightness which is essential for policy-setting.

To grasp labour market tightness, and potential inflationary strain from wages, I shall be conserving a detailed eye on a number of pay measures, particularly these (like AWE whole pay and ALCH) which embrace bonuses. Hopefully the present curiosity in bonuses sparks the gathering of latest information to shed extra mild on this characteristic of the labour market.

Josh Martin works within the Financial institution’s Exterior MPC Unit.

If you wish to get in contact, please e mail us at bankunderground@bankofengland.co.uk or go away a remark beneath.

Feedback will solely seem as soon as permitted by a moderator, and are solely revealed the place a full title is equipped. Financial institution Underground is a weblog for Financial institution of England workers to share views that problem – or assist – prevailing coverage orthodoxies. The views expressed listed here are these of the authors, and are usually not essentially these of the Financial institution of England, or its coverage committees.

[ad_2]