[ad_1]

Treasury yields have risen sharply in current months. The yield on essentially the most lately issued ten-year observe, for instance, rose from 1.73 % on March 4 to three.48 % on June 14, reaching its highest degree since April 2011. Growing yields end in realized or mark-to-market losses for fixed-income buyers. On this submit, we put these losses in historic perspective and examine whether or not longer-term yield modifications are higher defined by expectations of increased short-term charges or by buyers demanding better compensation for holding Treasury securities.

Improve in Yields = Lower in Returns

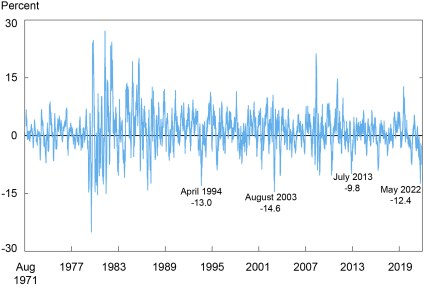

As yields and costs transfer inversely, the current sharp rise in yields has resulted in losses to the homeowners of Treasury securities. The chart beneath reveals that returns primarily based on the ten-year, zero-coupon yield had been -12.4 % for the two-month (forty-two-day) interval ending Might 5. (All yields and returns on this submit are nominal and therefore don’t account for inflation). The decline is the biggest since August 2003 (-14.6 %), and April 1994 earlier than that (-13.0 %).

Current Treasury Returns Are Extremely Unfavorable

Be aware: The chart plots the rolling, cumulative, two-month (forty-two buying and selling day) returns on a hypothetical ten-year, zero-coupon Treasury bond from August 16, 1971 to June 17, 2022.

Selloffs Outlined

As a result of the size of a bond market selloff could also be shorter or longer than two months, we undertake a versatile strategy to defining selloffs. We first cumulate returns for a hypothetical ten-year, zero-coupon Treasury safety from August 1971, figuring out every time cumulative returns attain a most for the period-to-date. We then undergo the info a second time, cumulating returns from the maximum-to-date. Every time a cumulative return drops beneath the utmost, we are saying {that a} selloff has began. When the cumulative return later reaches a brand new most, in order that the losses are recovered, we are saying the selloff has ended. We used the same strategy in our submit the 2013 selloff in historic perspective.

Our algorithm identifies forty-two selloffs through which the cumulative return for the ten-year, zero-coupon bond drops beneath -5 %. The typical most cumulative loss for such selloffs is 11.1 %, and the worst selloff resulted in a 38.4 % loss (for an episode between June 1980 and August 1982). The typical size of a selloff of 5 % or bigger is 214 buying and selling days (excluding the present selloff, for which the tip date isn’t but identified), the minimal is 21 days (for an episode between August and September 1982), and the utmost is 722 days (for an episode between July 2016 and Might 2019).

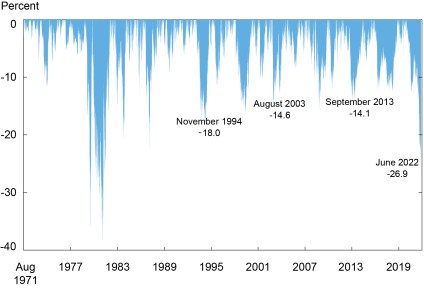

Present Selloff Largest in 40 Years

The chart beneath plots the selloffs, displaying that the present one is the biggest in 40 years, exceeding these seen in 1994, 2003, and 2013. As of publication date, the trough of the present selloff occurred on June 14, with a cumulative return of -26.9 %, versus -14.1 % in September 2013, -14.6 % in August 2003, and -18.0 % in November 1994. None of those episodes compares with the steep losses seen in the 2 Volcker-era selloffs of 1979-80 (-36.0 %) and 1980-82 (-38.4 %).

Present Selloff Is Higher than These Seen in 1994, 2003, and 2013

Be aware: The chart plots the cumulative returns on a hypothetical ten-year, zero-coupon Treasury bond throughout bond market selloffs, as outlined within the textual content, between August 16, 1971 and June 17, 2022.

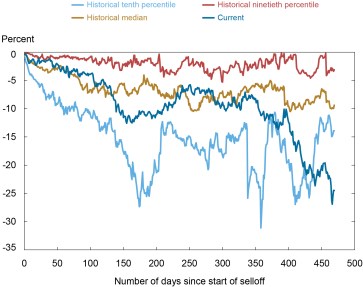

Tempo of Selloff Corresponding to Others till Not too long ago

The subsequent chart plots the cumulative returns of the present selloff over time, relative to the distribution of returns for all previous selloffs over time. It reveals that the present selloff tracks the median for previous selloffs at a comparable stage for the primary 400 days, however then diverges. The current divergence displays the sharp rise in yields, and decline in returns, between March 4 and June 14.

Tempo of Selloff Corresponding to Historic Median till Not too long ago

Notes: The chart compares the cumulative returns in occasion time for the present selloff with the distribution of cumulative returns for all selloffs (conditional on a selloff lasting that many days) between August 16, 1971 and June 17, 2022. At 450 days, the historic distribution is predicated on 5 selloffs.

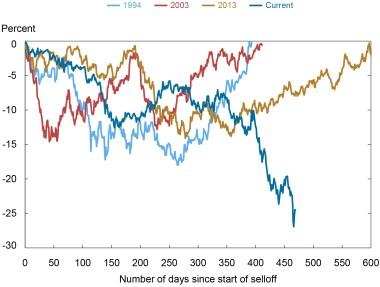

Size of Selloff Longer than Most

The chart beneath plots the cumulative returns of the present selloff over time, relative to the selloffs in 1994, 2003, and 2013. The present selloff once more diverges most notably from the others after day 400. The chart additionally reveals that the 1994 and 2003 selloffs ended round day 400, whereas the present one was shortly worsening at that stage. Actually, of the forty-one different selloffs since 1971 with cumulative returns beneath -5 %, solely 5 have lasted 450 days, the size of the present selloff as of Might 20.

Present Selloff Operating Longer than 1994 and 2003 Selloffs

Be aware: The chart compares the cumulative returns in occasion time for the present selloff with the 1994, 2003, and 2013 selloffs.

What Explains the Selloff?

What explains the present selloff? Are buyers anticipating increased short-term charges than simply a short while in the past? Or can some, or all, of the rise in yields be defined by a rise in time period premia, in order that buyers are demanding better compensation for the chance of holding longer-term Treasuries? To reply these questions, we use ten-year, zero-coupon time period premia estimates from Adrian, Crump, and Moench (2008) and—for every selloff—cumulate the returns that may be defined by modifications within the time period premium alone.

Our findings, reported within the chart beneath, counsel that the rise in yields over the primary yr or so of the present selloff (beginning in August 2020) may be defined by a rising time period premium. That’s, the cumulative returns primarily based on the time period premium alone (the pink line) are of comparable magnitude because the cumulative returns primarily based on the uncooked yields (the blue space). In distinction, the mounting unfavourable returns since late 2021, amidst rising prospects of tighter financial coverage, may be defined by expectations of upper short-term charges. The discovering that the time period premium modified solely modestly as soon as coverage began tightening in early 2022 is in line with the proof from previous financial tightenings reported in this 2013 submit.

Larger Brief-Time period Price Expectations and Time period Premia Clarify Present Selloff

Be aware: The chart plots the cumulative returns on a hypothetical ten-year, zero-coupon Treasury bond throughout bond market selloffs towards the cumulative returns in the course of the selloff attributable to modifications in time period premia for the August 16, 1971 to June 17, 2022 pattern interval.

Selloffs In contrast

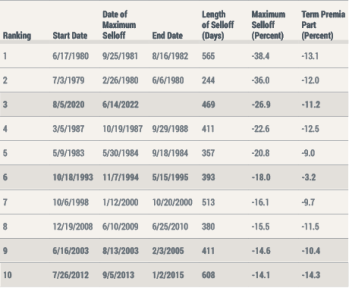

We checklist the attributes of the ten largest bond market selloffs since 1971 within the desk beneath. The 4 selloffs highlighted on this submit—1994, 2003, 2013, and 2022—are ranked sixth, ninth, tenth, and third, respectively, and highlighted with shading. Many of the selloffs, together with the present one, have a time period premium part, albeit one that’s appreciably smaller than the selloff as an entire. In distinction, the 2013 selloff stands out as having been pushed fully by modifications within the time period premium.

Present Selloff Is Third Largest since 1971

Notes: The desk stories traits for the ten largest bond market selloffs between August 16, 1971 and June 17, 2022. Figures within the final two columns mirror the interval between the beginning date and the utmost selloff date. The 1994, 2003, 2013, and present selloffs are highlighted with shading.

When May the Selloff Finish?

Following our definition of selloffs, the present selloff will finish when cumulative returns from the beginning of the selloff rise again to zero. Provided that the selloff lately reached a brand new nadir of -26.9 %, a big decline in yields can be crucial to finish the selloff anytime quickly. This appears unlikely, partially given current inflation readings and expectations of upper short-term charges amongst each policymakers and market members. The selloff would additionally ultimately finish even when yields didn’t change, because the yield from holding Treasury securities in the end offsets previous capital losses. On the present degree of rates of interest (as of June 17, 2022), and assuming no additional charge will increase, and no charge decreases, our algorithm means that it might take about seven years for buyers to recapture losses accrued because the begin of the selloff.

Tobias Adrian is monetary counsellor and director of the Financial and Capital Markets Division on the Worldwide Financial Fund.

Michael J. Fleming is the top of Capital Markets Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Easy methods to cite this submit:

Tobias Adrian and Michael Fleming, “The Bond Market Selloff in Historic Perspective,” Federal Reserve Financial institution of New York Liberty Road Economics, July 14, 2022, https://libertystreeteconomics.newyorkfed.org/2022/07/the-bond-market-selloff-in-historical-perspective/.

Disclaimer

The views expressed on this submit are these of the creator(s) and don’t essentially mirror the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. As well as, the views expressed on this presentation are these of the authors and don’t essentially mirror the views of the Worldwide Financial Fund, its Administration, or its Government Administrators. Any errors or omissions are the accountability of the creator(s).

[ad_2]