[ad_1]

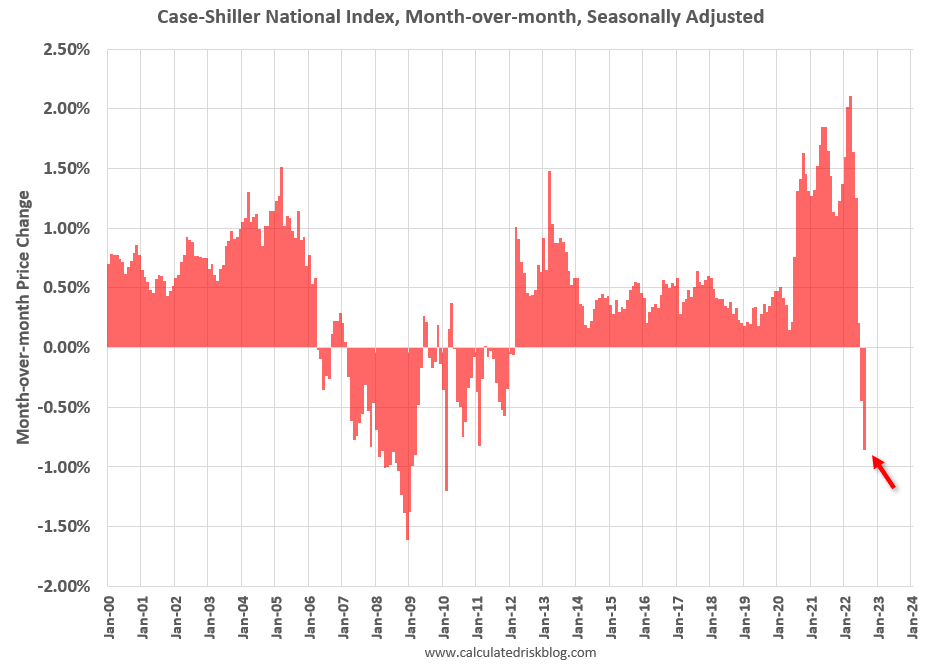

In the present day we realized that residence costs had their largest drop since 2009. That is only a small preview of what I imagine we’ll see within the coming months because the market adjusts to 7% mortgages.

In truth, loads of the financial knowledge will seemingly worsen. We simply heard from the Chief Enterprise Economist at S&P World opine on the latest World Flash US Providers PMI report. He stated:

“The US financial downturn gathered vital momentum in October, whereas confidence within the outlook additionally deteriorated sharply.”

I don’t need to sound alarmist, however brace yourselves for some awful headlines as rate of interest will increase work their approach by our financial system. Really, you’re most likely already calloused to the continuous negativity. Michael Cembalest stated:

“I learn round 1,500 pages of analysis every week and essentially the most constant message now’s a litany of gloom on earnings, valuations, wage and value inflation, Central Financial institution coverage normalization, housing, commerce, vitality, the surge within the US$, China COVID coverage, and many others”

Once you see issues like “A litany of gloom” you’ll be able to make sure that the market is conscious of the scenario we’re in and has adjusted danger belongings accordingly. No one is aware of the place we go subsequent, however the inventory market has already priced in some carnage, eradicating 25% from the S&P 500, 35% from the Nasdaq-100, 50% from Fb, Nvidia, and Disney, and 80% from Shopify and Coinbase and the like.

Overweighting right this moment’s information, for higher and for worse, will get buyers in hassle as a result of right this moment is already priced in. Stanley Druckenmiller just lately relayed this message to an viewers, saying: “Don’t spend money on the current. The current will not be what strikes inventory costs.”

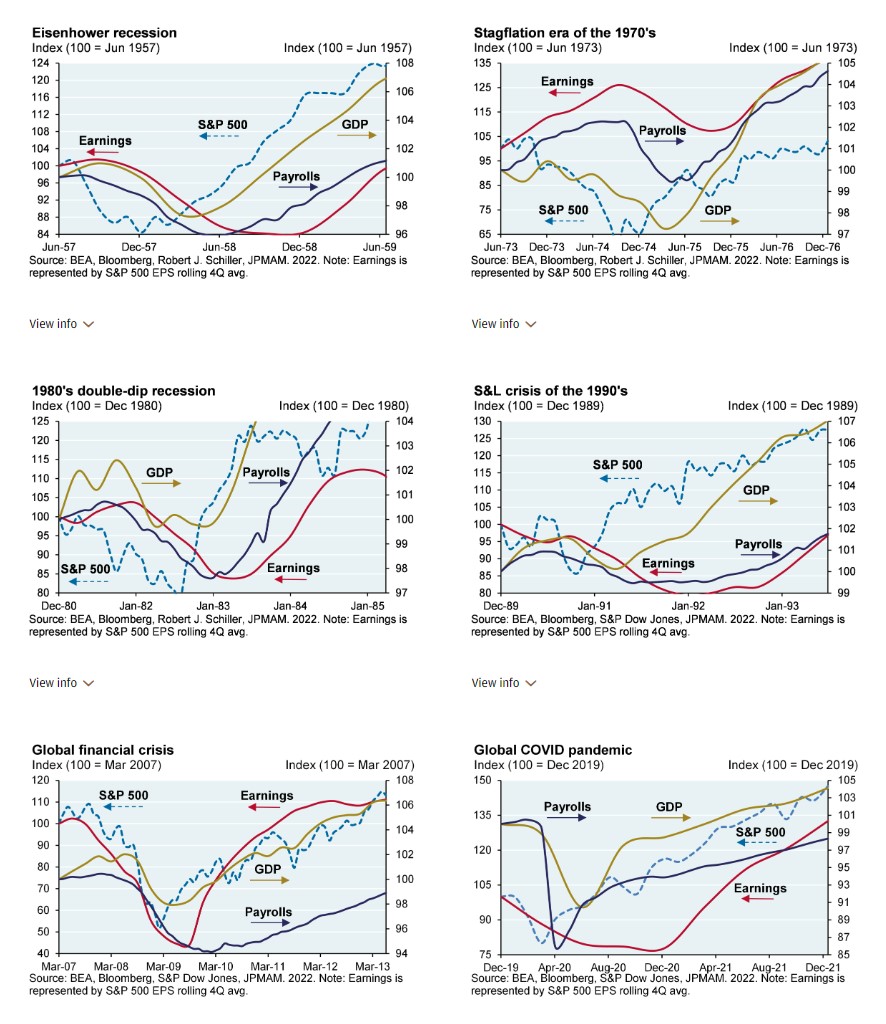

Michael Cembalest has a fantastic visible illustration of what Druckenmiller is speaking about. The inventory market is forward-looking and has an uncanny skill to backside whereas the info continues to bitter. It stops taking place whereas GDP, employment, and earnings deteriorate.

That is the way you’ll see seemingly incongruous headlines like “Dow Jones positive factors 900 factors whereas unemployment hits a 24-month excessive.” The market has higher long-term imaginative and prescient than we do, which is likely one of the trickiest elements of a bear market. Every part in your intestine will let you know to promote. It’s going to let you know that issues are going to worsen. And it’s most likely proper. Issues will worsen! However the market can have already regarded previous it.

Josh and I are going to cowl this and far more on tonight’s What Are Your Ideas?

[ad_2]