[ad_1]

Pricey associates,

Our hearts exit to individuals around the globe whose lives are being wracked by forces past their management, whether or not that’s the insanity of dictators or the ravages spawned by the world’s more and more unstable local weather. These of us characterize wants far past the annoyance attributable to our collective lack of $9 trillion within the inventory market’s ongoing revaluation.

These of us solely not directly affected by such tragedies have three imperatives:

- Assist these in want now. No, you possibly can’t repair every part however you are able to do some good. Charity Navigator affords credible steering whether or not you’re involved concerning the courageous souls in Ukraine or the shocked survivors of Hurricane Ian.

- Flip our vitality, resolve, and creativity to stopping their reoccurrence.

- Have a good time the every day magnificence and pleasure of life. Actually. Discover the great, not simply the unhealthy. That may depart you each extra resilient and extra capable of handle adversity when it presents itself.

A lot of this challenge will deal with the twin challenges of holding issues collectively now and actively making ready to achieve within the higher occasions (inevitably) to return.

Survive now, thrive later

The query we most frequently hear from associates is, “this market is loopy, and the stress is killing me. What on earth ought to I be doing? Run away? Cost ahead? Faux none of this ever occurred?”

There may be little or no purpose to anticipate wholesome returns from shares or bonds within the close to time period. The Federal Reserve is on a mission (to crush inflation), they usually’re very conscious of monetary historical past (the Fed’s untimely tightening in 1936 and 1937 led to a catastrophic crash, and their repeated giveaways within the decade following the 2007-08 international monetary disaster triggered the behaviors that triggered the 2021-202? international inflation disaster). Chair Powell has repeatedly invoked the identical warning: “The historic document cautions strongly in opposition to prematurely loosening coverage.”

The Feds are going to inflict ache on us as a way to change our expectations and behaviors. The longer it takes for these issues to alter – the Fed guarantees that coverage is pushed by “the info,” and the info in query are measures of softening employment, slowing progress, tighter job markets, weaker housing demand, and slowing costs.

Kai Ryssdal: I would like you to roll with me on this final one. We’ve received just a little sport we play on the present. It’s known as “What’s Jay Powell pondering in 5 phrases or much less?”

Jay Powell: 5 phrases or much less. I’m gonna go together with what I actually am pondering is “get inflation again beneath management.” (Market, 5/12/2022)

Doing that can, in all chance, imply triggering a more-or-less extreme recession within the US within the subsequent 12 months or so, which spreads to different economies. We’re not there but, definitely, however investor Stanley Druckenmiller can be “shocked” if we didn’t have “a tough touchdown” by the top of subsequent 12 months. (The comfortable fiction of a “delicate touchdown” is just not supported by the historical past of Fed interventions, which comprise just one occasion of a tightening cycle which didn’t tank the financial system.) Ned Davis Analysis places the chances at 98%, Bloomberg’s survey places the Eurozone at an 80% danger Vanguard’s economists are round 65% over the subsequent two years. Mohammed el-Erian merely describes the chance as “uncomfortably excessive.”

Which could, or may not, be the event for an extra 20-40% decline within the inventory market. Nobody is aware of.

Supply: QFM Asset Administration

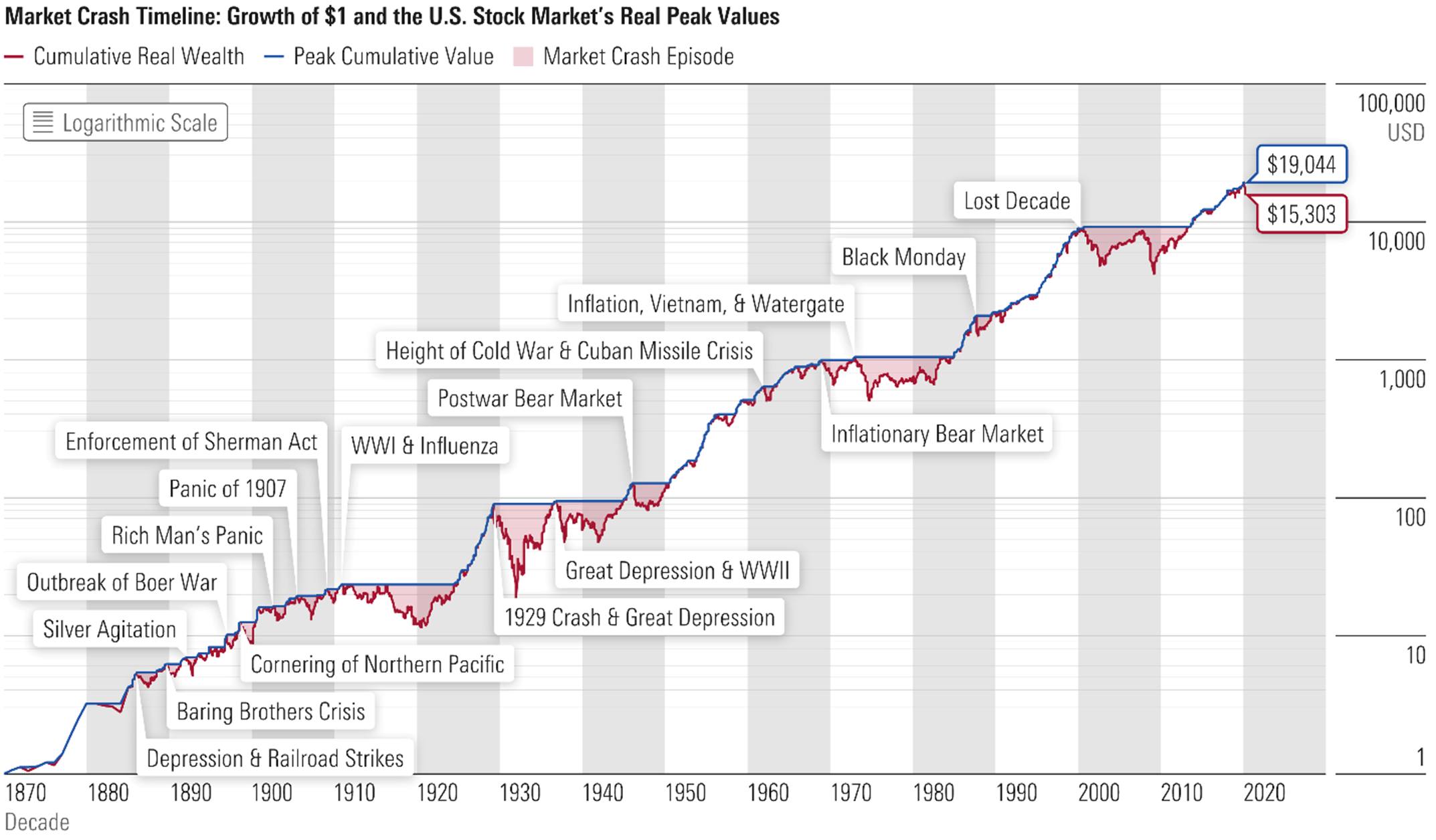

Uncertainty, dislocation, crashes, and stagnation are completely regular. Within the present phrase, “they’re featured, not flaws.”

So what’s to be finished? Our reply is straightforward.

Step One: Survive now.

There are a bunch of small, wise strikes that may allow you to make some modest beneficial properties with out corresponding dangers. On this challenge, Devesh Shah factors you to the risk-free I Bonds that are actually yielding over 9% and to the virtues of tax-loss harvesting and portfolio rebalancing as supplying you with some reduction and a few respiration room. Sequence I Bonds: A Ray of Hope

In mid-September, we tweeted out a warning and an funding suggestion:

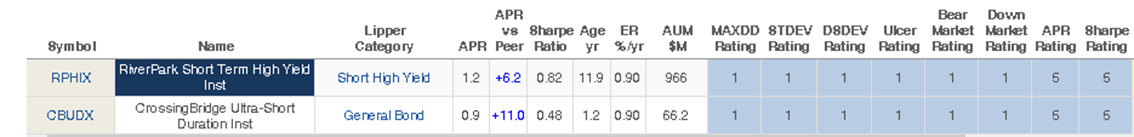

Simply two short-term funds have generated optimistic Sharpe ratios YTD: RiverPark Quick-Time period Excessive Yield and its sibling CrossingBridge Extremely-Quick. Each are managed by Cohanzick Administration. CrossingBridge has a $50,000 minimal, RiverPark is $1000 for retail shares and $50,000 for institutional.

Cohanzick avers, “Return of Capital Is extra vital than return on capital,” which is mirrored within the prime tier efficiency of all of their funds (by way of 9/30) in a tumultuous market:

| YTD return | Efficiency inside its peer group | |

| RiverPark Quick-Time period Excessive Yield | 1.19% | High 1% |

| CrossingBridge Extremely-Quick Length | 0.68% | High 7% |

| CrossingBridge Pre-Merger SPAC ETF | 0.48% | High 1% |

| CrossingBridge Accountable Credit score | -0.80% | High 1% |

| CrossingBridge Low Dur Hello Yld | -0.94% | High 1% |

| RiverPark Strategic Revenue | -3.60% | High 3% |

So one suggestion for the instant future is to generate a strategic money cushion.

The opposite may really feel odd. Don’t be afraid. It’s recommendation we provide not as a result of we predict issues are nice. It’s recommendation we provide exactly as a result of issues are profoundly unbalanced.

Step Two: Thrive later.

If there’s a recession, small-cap shares and rising markets shares, and rising markets worth shares will get creamed. That is to say, property which are among the many most cost-effective wherever will get noticeably cheaper.

After which, they’ll rocket. That’s the sample of post-recession efficiency. Sensible traders will start planning now to revenue then. Since we’re spectacularly unhealthy at timing markets, don’t. Lengthy-term traders ought to:

- Double-check their long-term strategic plan. The 2 key questions that your plan should reply are, “as a way to have a great probability of reaching the targets I’ve set, (1) how a lot should I make investments month-to-month (2) by which asset lessons?” If the plan is sensible, even when 2022 sucks, don’t undercut your self by getting all twitchy.

- To the extent that your plan means that you can spend money on high-risk property, begin figuring out compelling methods now and establishing small positions within the funds (which incorporates ETFs) which you’ll be gloating over in 2025 and past. That doubtless entails elevated rising markets, worldwide, small-cap, and worth publicity.

The flight of traders who misunderstood their very own danger tolerance has created alternatives for the remainder of us. After the choice in September to reopen their six closed funds, all 20 of the Wasatch funds are actually open to new traders. Likewise, William Blair EM Small Cap is accepting new cash for the primary time in years.

Our colleague Lynn Bolin explores the chance that our robotic overlords, maestros of black field funds, may likewise supply benefits within the subsequent market. Shining the Mild into Black Field Funds

Have a good time Seafarer

Devesh Shah spent dozens of hours in August talking with rising markets managers, an effort that culminated in his distinctive September essay “Rising Markets (EM) Investing within the Subsequent Decade: The Recreation.” With its companion piece on “The Gamers,” it was the most-read article within the challenge.

Devesh Shah spent dozens of hours in August talking with rising markets managers, an effort that culminated in his distinctive September essay “Rising Markets (EM) Investing within the Subsequent Decade: The Recreation.” With its companion piece on “The Gamers,” it was the most-read article within the challenge.

Devesh shared two vital conclusions:

- EM Worth Shares are in all probability the most cost effective of the shares on this planet, particularly contemplating the unrecognizing power and success of many EM managers.

- Low cost securities with good companies, excessive ROE, and excessive FCF present a danger flooring at the moment and an opportunity at robust returns tomorrow. Even when it’s not instant, even when the markets are scary, the chance is knocking. Let’s not twiddle thumbs and do nothing.

The entire August interviews – with leaders at Rondure, Causeway, William Blair, Pzena, and others – have been catalyzed by a collection of conversations with Andrew Foster, founding father of Seafarer Capital and one of the crucial considerate guys within the business.

In a tough surroundings, these managers posted a few of the business’s finest returns. Listed here are the highest ten diversified EM funds based mostly on complete returns by way of 9/30/2022.

- Seafarer Abroad Worth, a five-star (Morningstar) Nice Owl (MFO) fund

- Ashmore Rising Markets Frontier

- Barrow Hanley Rising Markets

- Pzena Rising Markets Worth

- Silk Make investments New Horizons Frontier

- BlackRock Defensive Benefit

- Calvert Rising Markets

- Vaughan Nelson Rising Markets Alternative

- Rondure New World, a five-star fund (Morningstar)

- Seafarer Abroad Development & Revenue, a five-star fund (Morningstar)

If we take a look at the diversified EM funds (together with ETFs) with the highest YTD Sharpe ratios, Ashmore S&P Rising Markets Low Volatility is #1, Seafarer Abroad Worth is #2, Pzena EM Worth is #7, and Seafarer Abroad Development & Revenue is 10.

That constant success, in each absolute and risk-adjusted phrases, led CityWire to profile Seafarer Capital as their “boutique of the month” (registration required).

Dodge ARK

We warned of us concerning the inordinate danger of entrusting cash to Cathie Wooden at the same time as traders chucked tens of billions in her route. “That is definitely not to criticize the parents who chucked $37 billion at Ms. Wooden and her bevy of excessive vol ETFs in 2020. Actually, 1,100% asset progress in 12 months (together with $700 million within the House Exploration ETF) for a household of funds whose success is sort of completely depending on the continued flawlessness of a single particular person … what might probably go mistaken?” (5/2021)

Okay, quite a bit.

| 2020 | 2021 | 2022 | 3-year APR | |

| ARK Fintech Innovation ETF | 108 | -18 | -62 | -10% |

| ARK Israel Modern Know-how ETF | 34 | -4 | -40 | -5 |

| ARK Innovation | 153% | -23 | -60 | -3 |

| ARK Subsequent Technology Web | 158 | -17 | -62 | -1 |

| ARK Genomic Revolution | 181 | -34 | -46 | 5% |

| ARK Autonomous Know-how & Robotics ETF | 107 | 3 | -41 | 13.4 |

| ARK House Exploration & Innovation ETF | n/a | n/a | -34 | n/a |

Morningstar’s evaluation is solely caustic (“the technique has been one of many worst-performing U.S.-sold funds …Supervisor Cathie Wooden has since doubled down on her perilous method … her go-with-your-gut method [compounded by the fact that there are no discernible risk management controls] has harm many traders of late. It might harm extra sooner or later”(Robby Greengold, 9/9/2022, paid membership required).

We have been proper, however we have been hardly ever humorous.

Ms. Woods’ most up-to-date transfer has been the launch of a (ridiculously costly) fund that means that you can blindly belief in her means to select private shares, with the extra proviso which you could’t have your a refund.

Alex Rosenberg and Alex Steger rose to the problem of eviscerating the fund whereas concurrently being humorous and retaining their authorized division happy-ish. Their objective: saying solely good issues about ARK Enterprise. (9/30/2022).

“ARK Enterprise Fund,” they observe, “is a really nice identify,” so solely a cynic would recommend “that she’s taking her sizable fan base and ushering them into the retail investing construction that pays her the very best attainable charges for the longest attainable time frame.”

Issues we’ve seen earlier than and issues we haven’t

Wells Fargo is in bother once more. Allegedly “Wells Fargo hiring managers interview minorities even after a place has been stuffed as a way to recommend that it’s working in the direction of a extra various workforce, in addition to to spice up its personal variety statistics” (TheStreet.com, 9/26/22). After hitting their stride with a scandal a month, seemingly for years, I form of missed the reassuring rhythm of perfidy.

Wells Fargo is in bother once more. Allegedly “Wells Fargo hiring managers interview minorities even after a place has been stuffed as a way to recommend that it’s working in the direction of a extra various workforce, in addition to to spice up its personal variety statistics” (TheStreet.com, 9/26/22). After hitting their stride with a scandal a month, seemingly for years, I form of missed the reassuring rhythm of perfidy.

After which, one thing completely new! A crew of criminals posing as authentic fund advisors invented a wholly non-existent mutual fund, Archer Development Fund. In response to the SEC, the crooks created a web site after which claimed

that the Archer Fund had an annual fee of return of 47%, that it had overwhelmed the Russell Development Index for 5 straight years, and that it was “one of many solely Excessive-Watermark Funds obtainable available on the market.” The SEC additionally alleges these claims have been false. Certainly, the SEC alleges there was no Archer Development Fund.

Please be aware, too, that “Archer” is a standard identify, so this doesn’t check with the Archer household of funds nor to a Canadian fund working beneath that identify.

Thanks, as ever …

Many, many because of those that assist us hold the lights on. Wilson, S&F Advisors, William, Greg, Doug, William, David, and Brian – we respect your regular assist. James, Leah, and Radley – it was so good to listen to from you.

Wishing you nice pleasure,

[ad_2]