[ad_1]

Inflation is changing into a scorching matter in financial circles. Three rounds of stimulus checks and financial assist are pumping monumental quantities of cash into the American financial system. In response, long-term rates of interest have risen from all-time low ranges. This brings up an necessary matter for traders: How will we handle rate of interest threat in bonds?

Understanding how modifications in rates of interest have an effect on your bond investments is necessary. Purchasers look in direction of their bonds as a supply of earnings and stability. However bond costs can transfer up and down, similar to shares. Thus, it’s necessary to know why bond costs would possibly transfer up or down.

How do Modifications in Curiosity Charges Have an effect on Bonds?

Merely:

- If basic ranges of rates of interest are rising, bond costs can be falling

- If basic ranges of rates of interest are falling, then bond costs can be rising

This may really feel counterintuitive, so to know why that is the case, we’ll take a look at an instance.

Instance of How Curiosity Charges Have an effect on Bond Costs

Uncle Charlie calls me up and wishes a $100 mortgage for 10 years. Whereas I like Uncle Charlie, I’m additionally an investor and know I can get 5% on my cash by shopping for a 10-year bond. So I inform Uncle Charlie, “Certain, I’ll provide you with $100 so long as you pay me 5% per yr.”

The subsequent day, basic rates of interest rise from 5% to six%. In my frustration that I may’ve gotten 6% on cash I lent to Uncle Charlie at 5%, I name my sister and ask her if she needs to purchase Uncle Charlie’s mortgage. My sister isn’t any idiot, and says, “Why would I pay you $100 for a mortgage that pays 5% once I can lend that very same $100 to another person at 6%??”

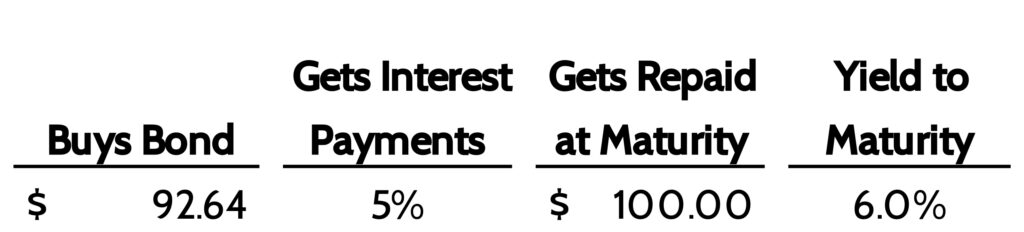

Since my sis loves her large brother and needs to assist, she comes up with one other concept. “I must earn 6% on my cash since that’s what I can get available in the market. So if you wish to promote me Uncle Charlie’s mortgage, I’ll provide you with $92.64 for it to compensate me for the truth that Charlie’s solely paying 5% per yr in curiosity.”

The discounted worth she’d purchase the mortgage at entitles her to earn cash above and past the 5% curiosity that Uncle Charlie is paying. In truth, if she buys the mortgage at that worth she’ll find yourself incomes 6%, all in.

Why? Recall that Uncle Charlie goes to provide her $100 on the finish of the mortgage time period. So my sister would make 5% curiosity per yr PLUS the distinction between what she purchased the mortgage for and what she’ll get on the finish of 10 years. Whenever you purchase a bond for kind of than “par worth” (i.e. $100) they name the overall return (curiosity + change in worth) the “yield to maturity.”

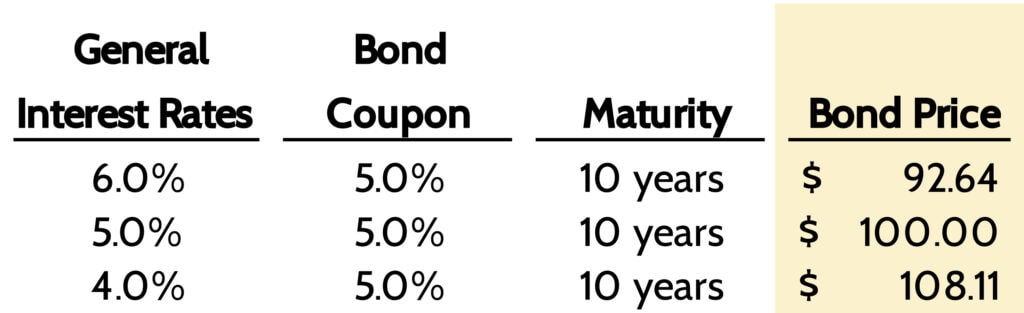

This instance reveals how modifications in rates of interest result in modifications in bond costs. Again to Uncle Charlie’s 5% mortgage. Any time basic rates of interest change, the value of his mortgage would change as seen under.

This dynamic is necessary to know. It signifies that the worth of the bonds in your portfolio – even ultra-safe U.S. Authorities bonds – can rise or decline in worth earlier than they mature. You may be assured to get $100 at maturity, however that doesn’t imply the value of the bond will all the time be $100. Whereas bond costs are extra steady and transfer lower than inventory costs, they may transfer. This explains how there may be rate of interest threat in bonds.

Measuring Curiosity Charge Danger in Bonds With Bond Length

We keep away from monetary jargon as a lot as potential in these newsletters. It’s like getting surgical procedure. You need the physician to elucidate to you what they’re going to do in sufficient element, however you don’t want all of the technicals that go together with it. “Simply give it to me straight, doc!”

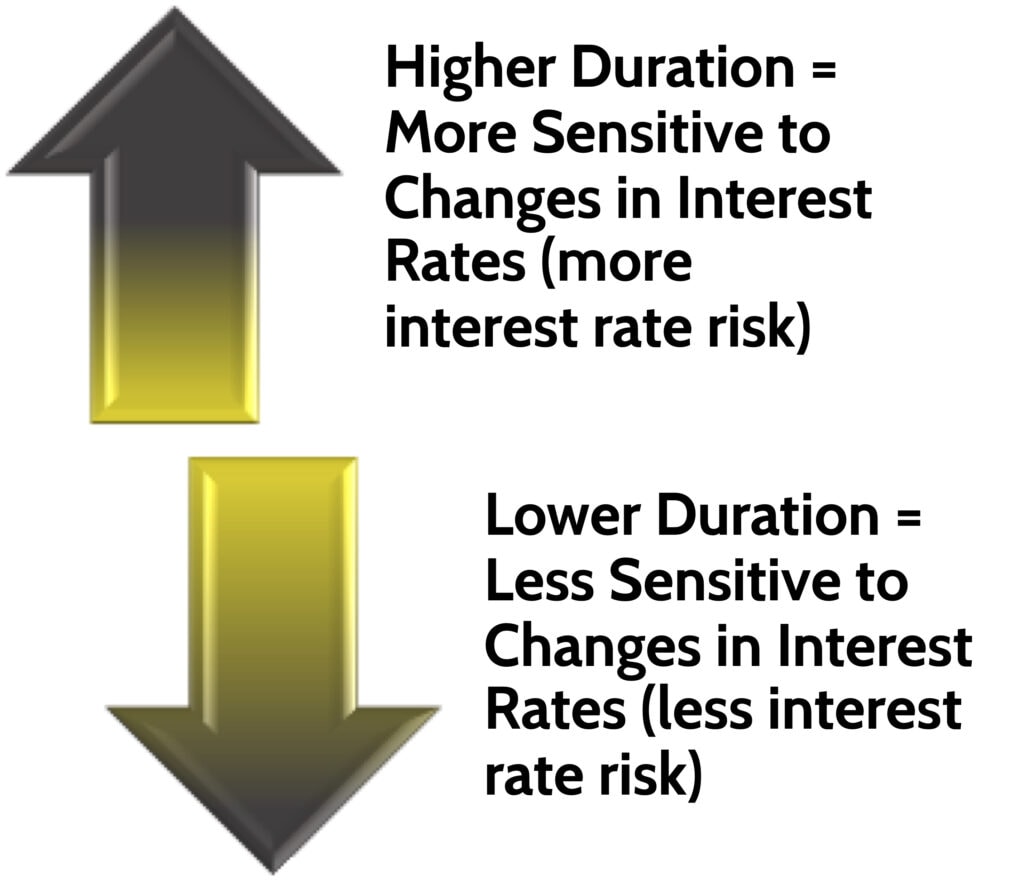

On the threat of breaking the “no jargon” rule, I need to introduce a time period that’s key to understanding how rates of interest have an effect on bond costs: Length. Bond period is a measure of how a lot a bond’s worth will change for a given change in rates of interest. So if rates of interest go up 1%, the bond’s worth is anticipated to vary X%.

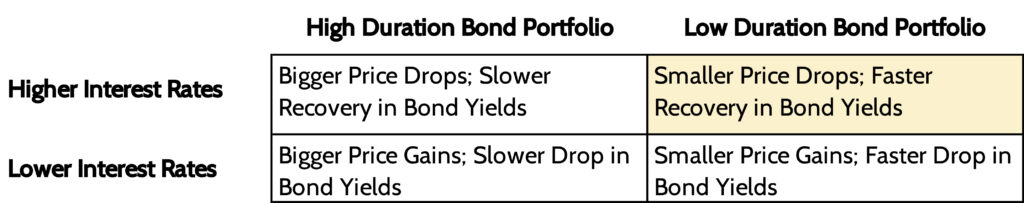

If a bond had excessive period, meaning its worth can be very delicate to modifications within the basic stage of rates of interest, no matter whether or not charges go up or down. Conversely, a bond with a decrease period is not going to see its worth transfer as a lot when rates of interest change.

The important thing drivers of a bond’s period are:

- The rate of interest the bond pays

- The maturity of the bond (i.e. what number of extra years till it matures)

For instance, a 100-year bond may have a really excessive period, whereas a 6-month bond may have a really brief period. An increase in rates of interest will harm the 100-year bond much more than the 6-month bond.

Why Does Bond Length Matter to You?

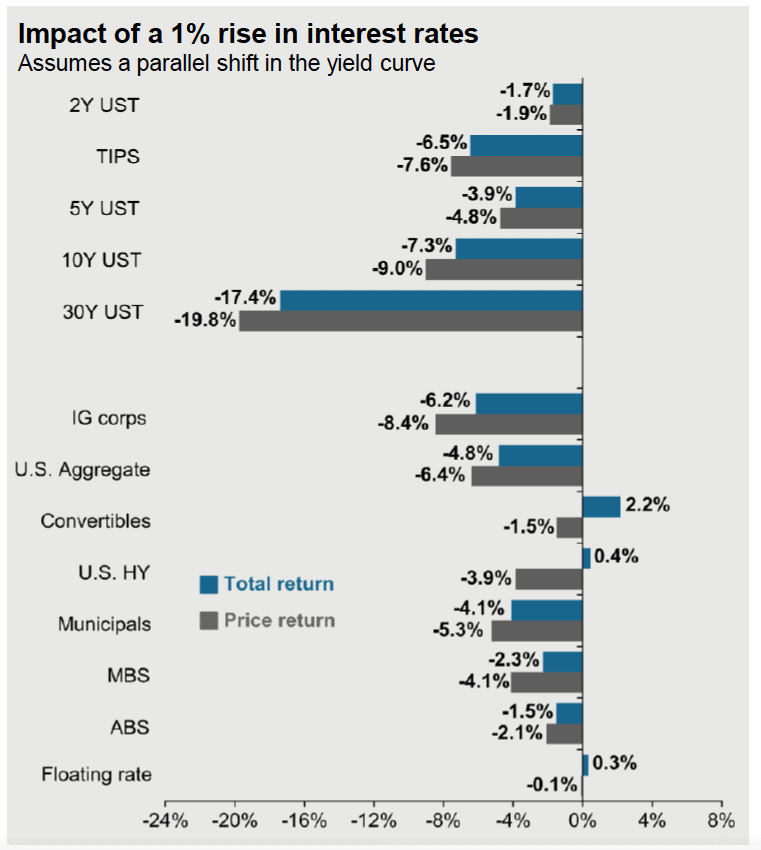

The explanation it’s necessary to have a primary understanding of bond period is as a result of it has an actual influence on the worth of your bond investments. JPMorgan Asset Administration simply printed a helpful chart trying on the estimated change in worth for varied kinds of bonds if rates of interest rose +1.0%.

Take a look at the instance of U.S. Treasury Bonds (USTs). Those who mature in 2 years would solely decline in worth by -1.9% if rates of interest rose 1.0%. However for a 30-year UST, the value would decline by -19.8%! It’s because 30-year bonds have a a lot larger period than 2-year bonds.

The opposite factor to note is that a rise (lower) in rates of interest hurts (helps) the worth of most kinds of bonds. Due to this fact, it’s necessary for bond traders to have diversified publicity to various kinds of bonds, simply as we advocate for inventory traders.

The final 10 years have witnessed extraordinarily low rates of interest in comparison with historical past. Even with the current rise in rates of interest, they’re as little as they’ve been since 1912.

So why does Bond Length matter to you? Ask your self a query: “Primarily based on the final 100 years of historical past, is it extra possible we’ll see larger rates of interest or decrease rates of interest?”

For those who answered “larger rates of interest” then you may refer again to the seesaw graph initially of this piece. From that, we all know bond costs will go down as rates of interest go up.

So how can we defend you – the FDS shopper – from larger rates of interest or rate of interest threat in bonds?

Reply: By proudly owning bonds with a shorter period. Decrease period = much less sensitivity to modifications in rates of interest.

The Drawback with Passive Bond Index Funds

Passive index investing has develop into very talked-about over the past 25 years. Mutual funds and exchange-traded funds (ETFs) that monitor an index are less expensive and extra tax environment friendly. It’s been a win-win for a lot of traders.

The issue with passive investing is that you simply’re beholden to how an index is constructed. And whereas investing in a “whole bond market” fund would possibly sound like the most effective and best method to put money into bonds, it will possibly additionally expose you to dangers you is probably not conscious of.

The most well-liked bond market index is the Barclays U.S. Combination Bond Index. Virtually each passive “whole bond market” fund you discover is invested on this index.

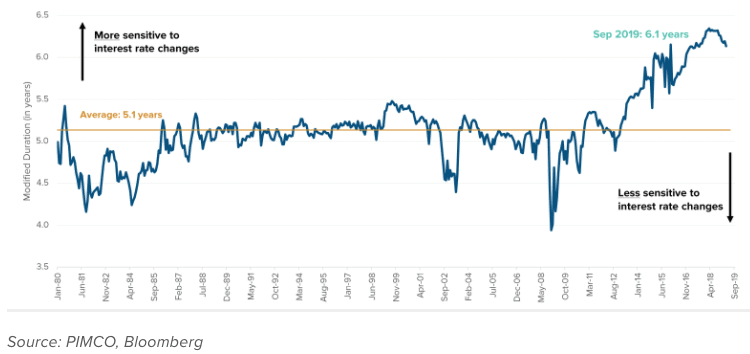

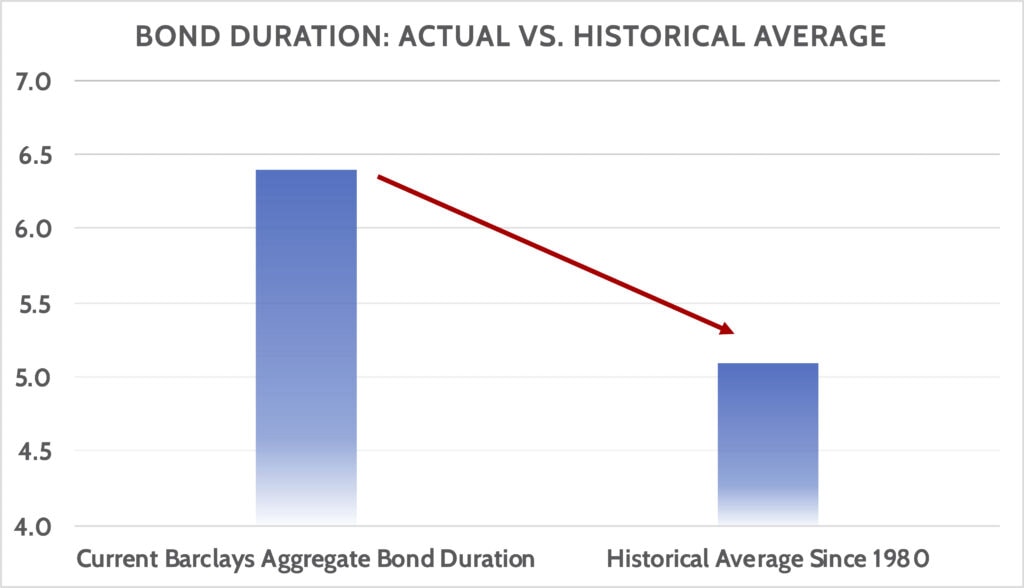

From 1980 to the International Monetary Disaster of 2008, the common period of this Combination Bond index was 5.1 years. Since then, the period (i.e. rate of interest threat) of this index has elevated considerably.

As of April 2021, the common period of the Combination Bond Index is 6.39 years, close to the very best stage on file.

The explanation period has elevated is that firms and governments have taken benefit of low rates of interest to borrow long-term debt. For instance, Apple just lately borrowed $1.75 billion that received’t be due till 2061 – 40 years from now! The rate of interest they’ll pay is simply 2.8%. They don’t want the money, however determined it was value borrowing cash at these low charges!

The rise in general bond period over the past 12 years is important. How important is this alteration? On the present stage, the general bond market has 25% extra rate of interest threat than it has had traditionally.

Let’s put the items collectively. Present rates of interest are the bottom they’ve been in 100 years, which means the subsequent logical transfer in charges is larger. But the bond market has by no means had as a lot rate of interest threat (period) because it does now. Greater charges with Excessive period = doubtlessly tough returns for bond traders within the years forward.

Structuring Bond Investments for a Rising Charge Atmosphere

If we face a backdrop of upper future inflation and ultimately larger rates of interest, how can we defend towards that? One of many key methods is to be sure to management the period of your bond investments.

When constructing inventory portfolios, we’re cautious to decide on investments which can be well-diversified. We all know we will’t keep away from seeing the worth of shares go down in a bear market. However having a well-diversified portfolio of shares can restrict the draw back to these occasions.

It’s the identical thought course of with Bonds. We all know if charges transfer larger, that may act as a headwind to all bonds. But we will management for this threat by setting up a portfolio of bonds with decrease period that mitigates a few of this threat.

The purpose of setting up a bond portfolio with decrease period is to restrict worth declines if rates of interest improve. The offsetting profit from this short-term worth decline is that the bonds in these funds will mature quicker and get replaced with higher-yielding bonds. This can assist the yield in your bond portfolio improve in a shorter period of time.

Nothing’s free of charge, and there are two tradeoffs with a lower-duration bond technique. First, the bond yield you get as we speak can be decrease than what you’d get on a excessive period bond technique. Second, you wouldn’t profit as a lot if rates of interest ended up declining as an alternative of accelerating.

What We’re Doing to Shield Shopper Bond Portfolios From This Curiosity Charge Danger in Bonds

As we step again and take a look at the massive image, right here’s what we see:

- Rates of interest are at 100-year lows.

- The federal government has deserted any semblance of fiscal restraint within the perception that prime debt ranges don’t matter.

- The Federal Reserve is explicitly concentrating on larger inflation.

Once we add issues up this implies larger inflation and ultimately, larger rates of interest to fight stated inflation. With that backdrop, it appears prudent to us to watch out with the rate of interest threat in bonds in shopper bond portfolios, even when there are tradeoffs to that technique. And that’s precisely what we’re doing.

This doesn’t imply concentrating on a bond period of zero. That may be akin to stuffing cash in a mattress and incomes 0% on it. As an alternative, we’re speaking about shifting a portion of bond investments to shorter-duration bond funds, so we keep near the long-term common period for the bond market. That is like what we did for purchasers final Fall after we moved a portion of their bond publicity to inflation-protected bonds.

Investor consideration usually gravitates in direction of what’s occurring in shares. Hopefully, this piece helps you perceive what’s occurring with the “protected” aspect of your funding ledger – Bonds. You don’t must be an professional in investing – that’s what you’ve employed us to do for you. However by being knowledgeable, you’re empowering your self to stay along with your plan via all types of market cycles.

[ad_2]