[ad_1]

The U.S. inflation fee stays stubbornly excessive, clocking in at 8.3% for this week’s newest studying.

Many individuals suppose this offers the Fed much more ammunition to proceed elevating short-term rates of interest from their present ranges of round 2.5%. Charges may get as excessive as 4-5% earlier than all is alleged and finished.

Ray Dalio thinks this may very well be a foul factor for the inventory market:

I estimate that an increase in charges from the place they’re to about 4.5 % will produce a couple of 20 % damaging affect on fairness costs (on common, although larger for longer length belongings and fewer for shorter length ones) based mostly on the current worth low cost impact and a couple of 10 % damaging affect from declining incomes.

This is smart from a monetary principle perspective. Any monetary asset is just the current worth of future money flows discounted again to the current. And the best way you low cost these money flows is thru rates of interest.

Increased rates of interest ought to, in principle, result in a decrease current worth.

This not solely is smart in principle however in widespread sense phrases as effectively. In case your hurdle fee is increased, you’re going to require a decrease beginning worth to make an funding worthwhile.

Dalio may very well be proper. That is the primary time in a very long time authorities bond yields have provided traders charges that might make them cease and take into consideration placing their money to work in danger belongings.

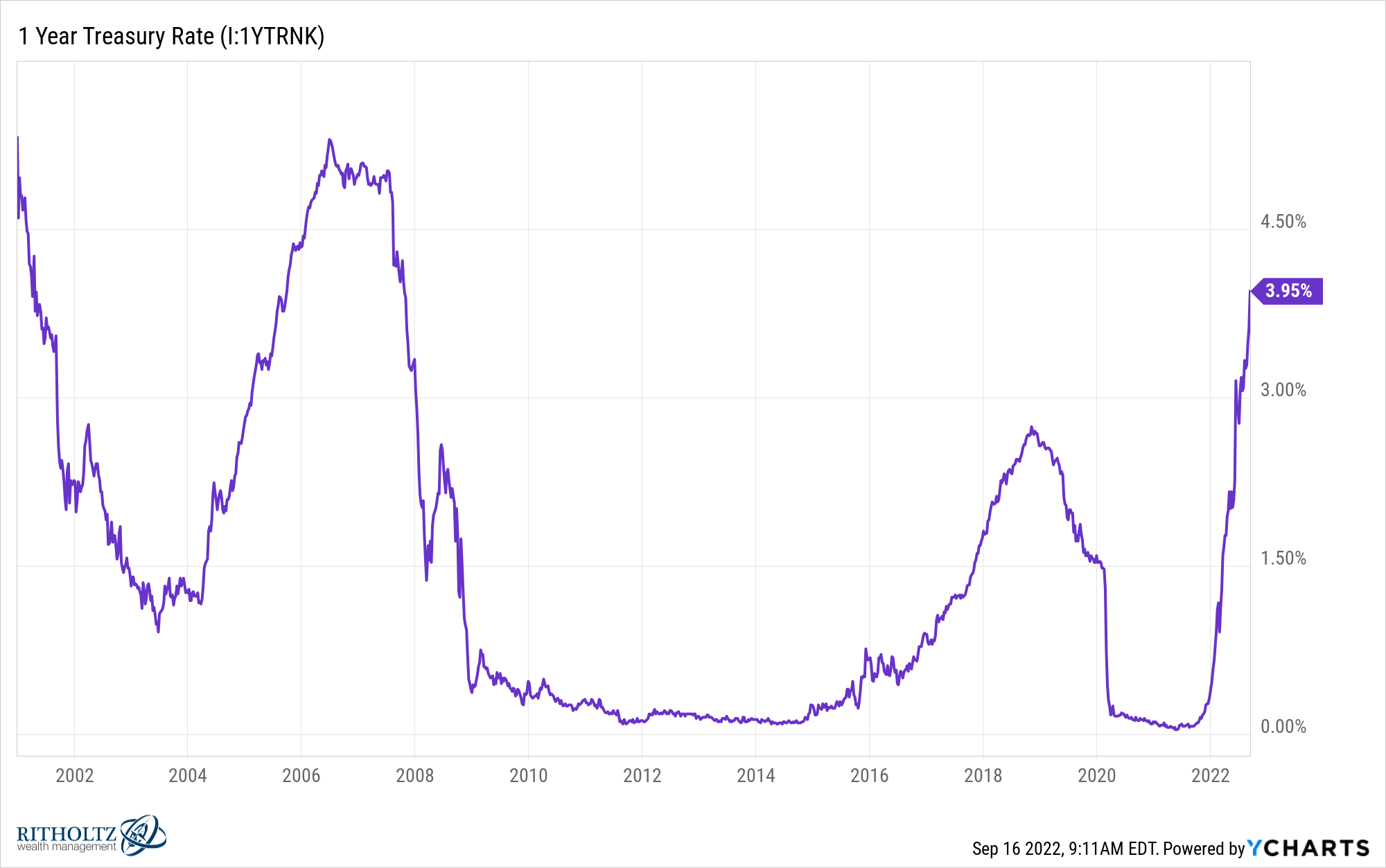

The one 12 months treasury is now yielding 4%. Actual yields stay damaging since inflation continues to be so excessive however these are the very best nominal yields for short-term bonds since earlier than the 2008 crash:

It’s not solely the extent of charges however the velocity at which they’re rising. The yield on one 12 months treasuries only a 12 months in the past was 0.07%. It’s up virtually 60x in a 12 months.

So is the inventory market screwed?

Possibly. Dalio’s logic is smart.

However the inventory market doesn’t all the time make sense, particularly in the case of rates of interest.

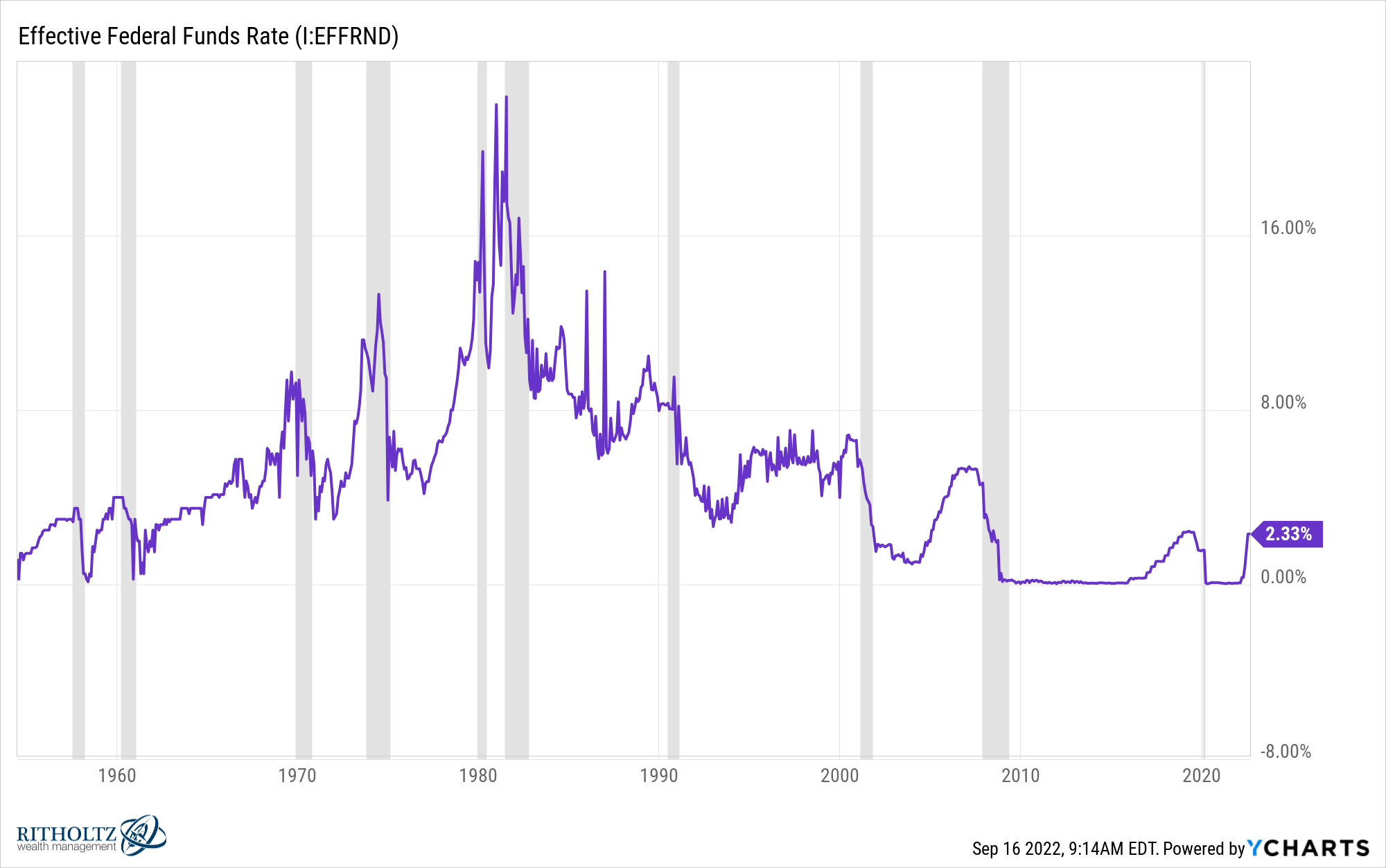

Right here’s the Fed Funds fee going again to the mid-Nineteen Fifties:

Rates of interest have been in secular decline for the reason that early-Eighties however the three-decade interval earlier than that was a secular rise in charges.

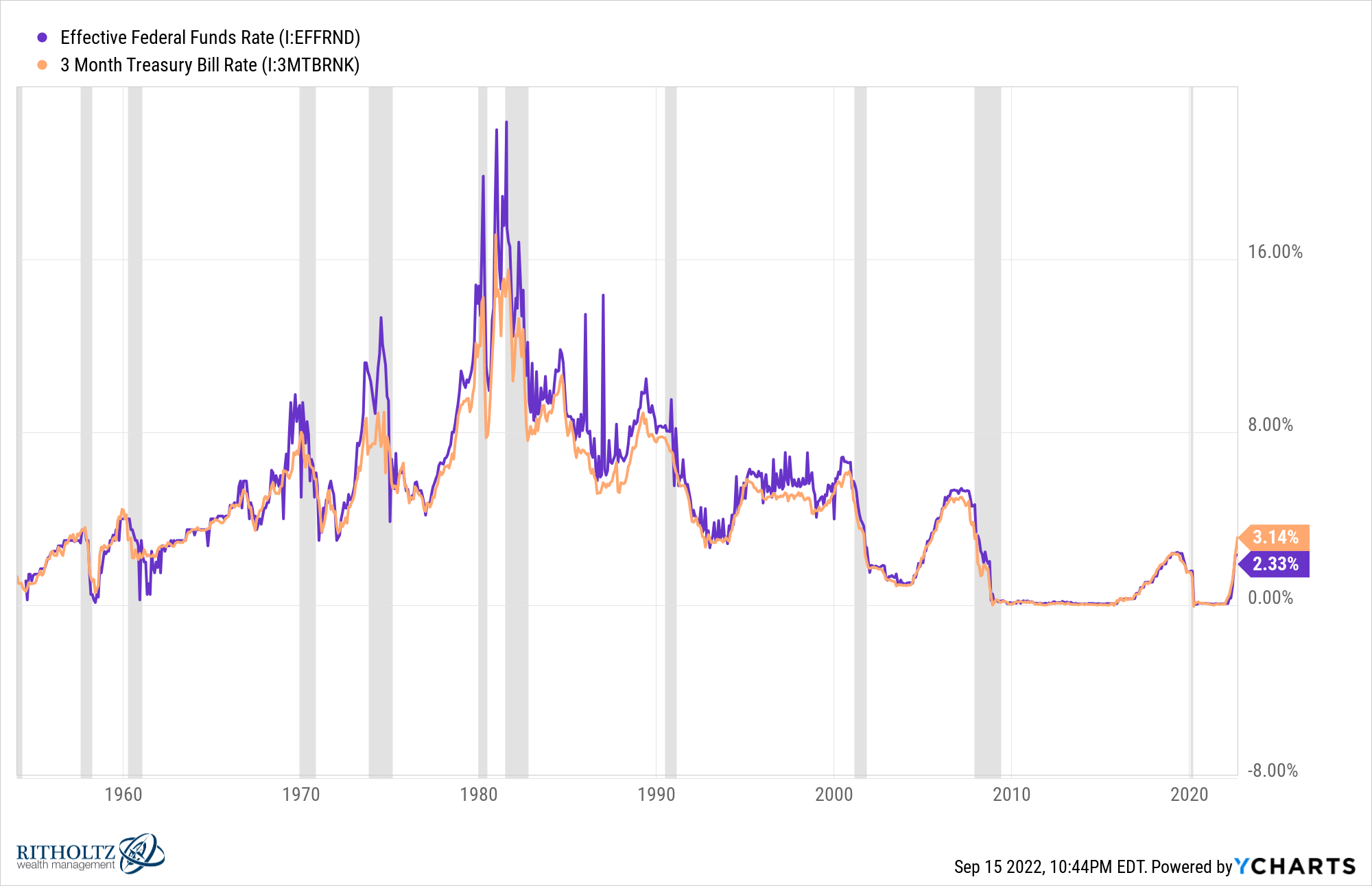

The three-month T-bill is a fairly respectable proxy for the Fed Funds Fee:

Since there are some actions in charges in-between conferences it’s simpler to make use of these short-term treasury payments as a proxy for historic comparisons.

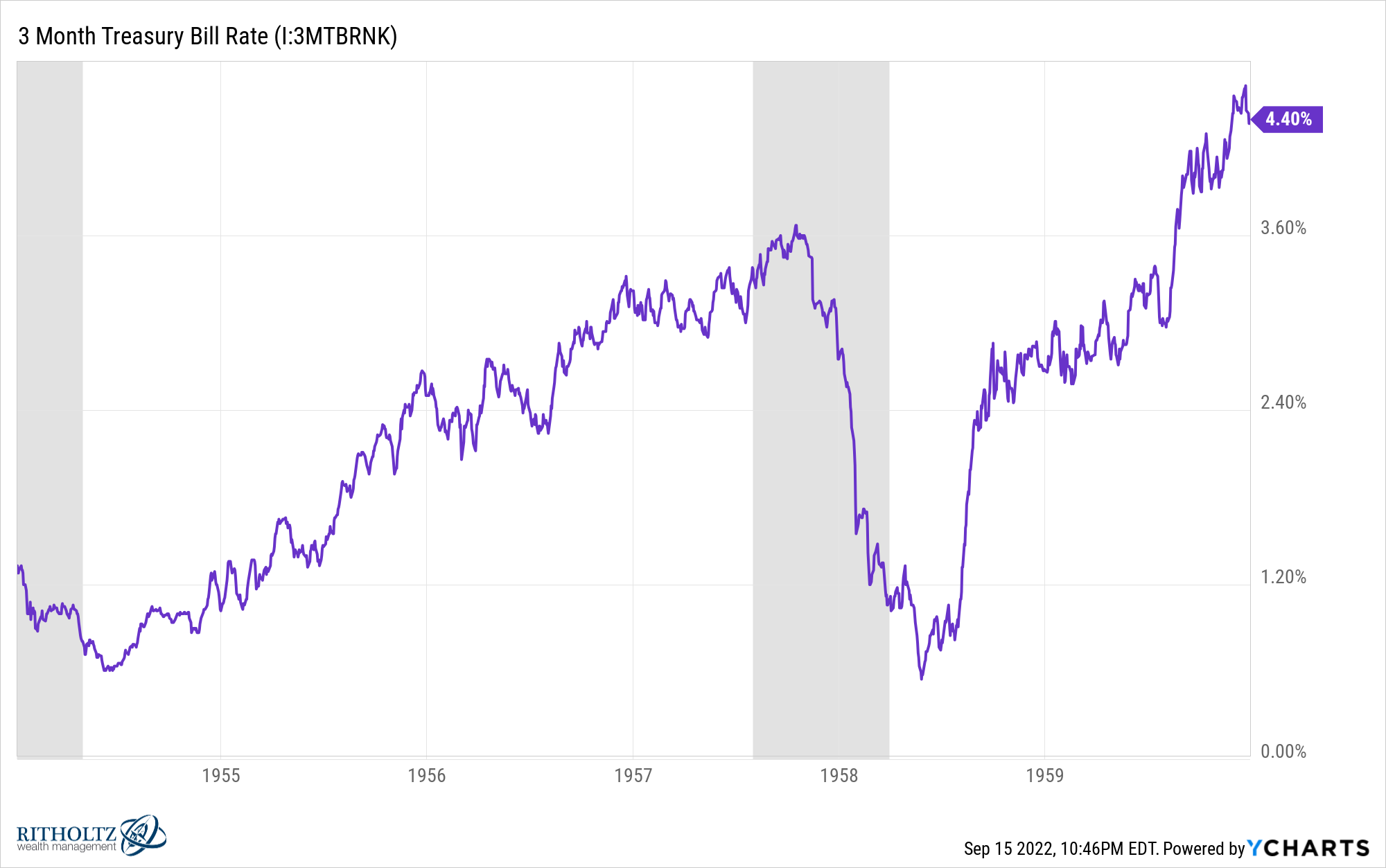

The three-month T-bill was simply over 1% in 1954 however ended the last decade at greater than 4%:

Throughout this timeframe, the S&P 500 was up 21% per 12 months or greater than 210% in whole.

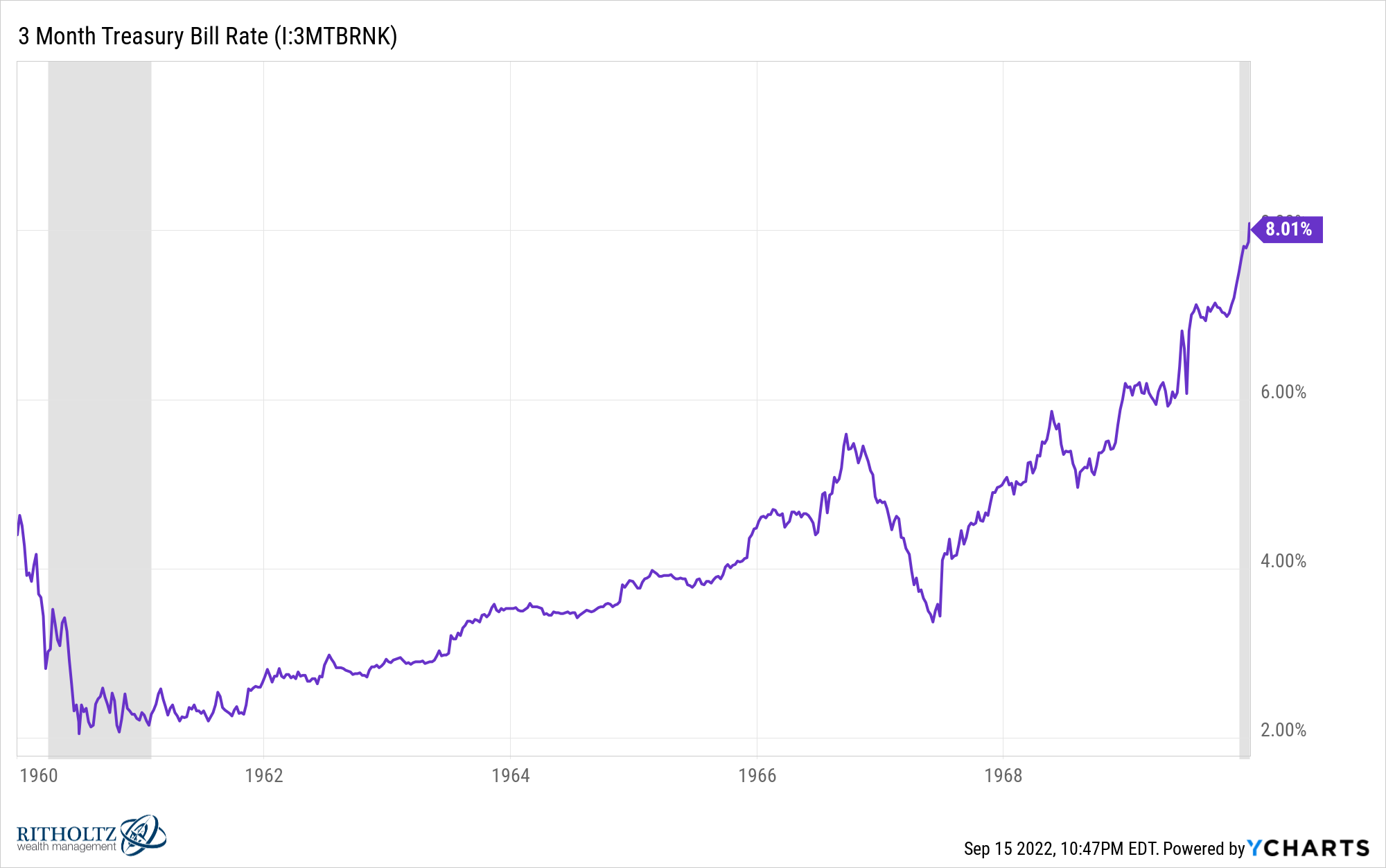

Quick-term charges practically doubled within the Nineteen Sixties, going from somewhat greater than 4% to eight%:

The Nineteen Sixties weren’t an incredible decade for the inventory market however the S&P 500 was up a decent 7.7% yearly. Shut to eight% per 12 months will not be unhealthy throughout a time when rates of interest doubled.

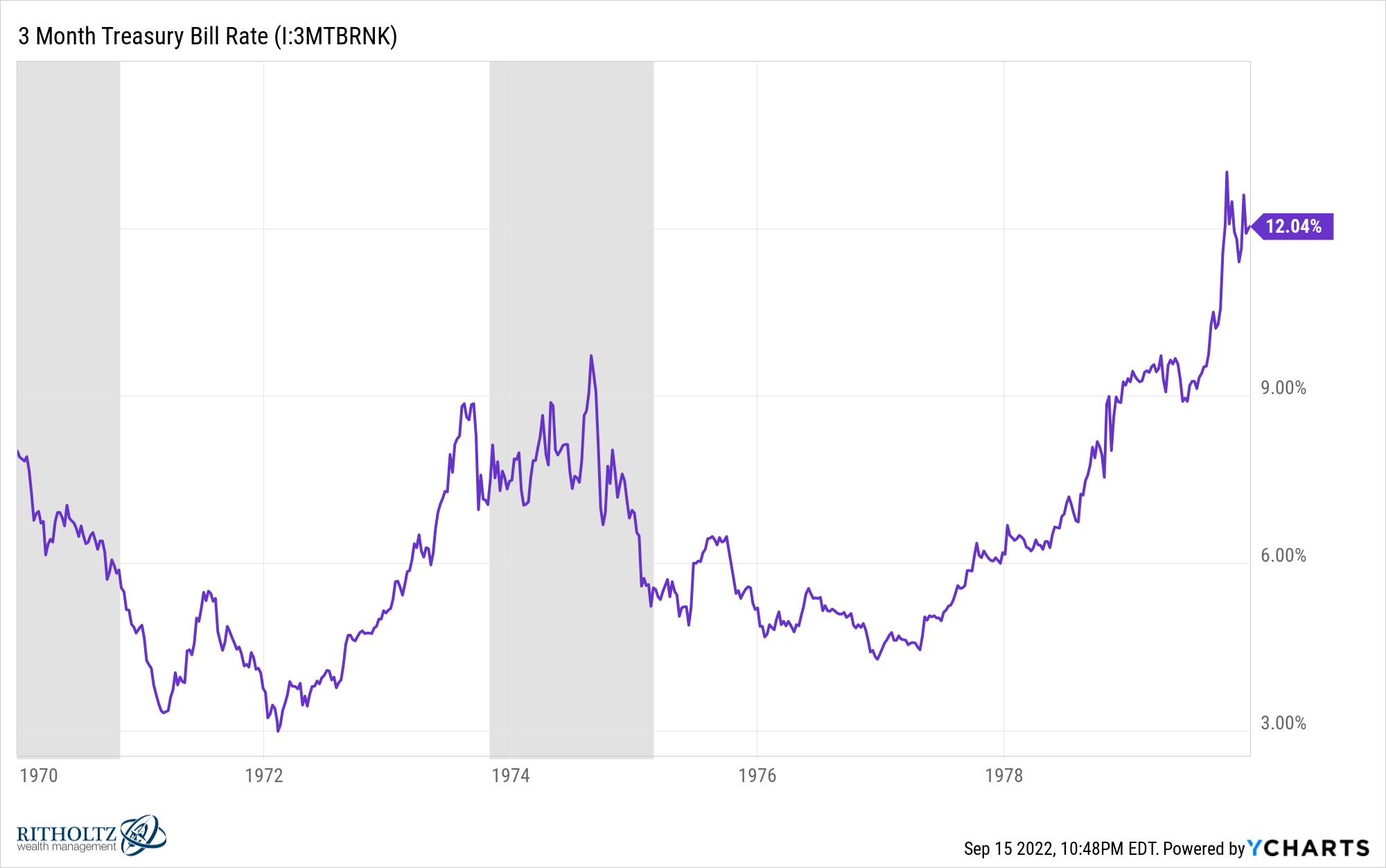

Within the Seventies, short-term yields went from 8% to 12%:

Nominally the U.S. inventory market did okay within the Seventies. Shares have been up 5.9% per 12 months whilst rates of interest have been breaking by means of double-digit ranges.

The issue is inflation was 7.1% so shares have been down on an actual foundation.

And that’s the most important distinction between the Nineteen Fifties, Nineteen Sixties and Seventies. Whereas inflation was greater than 7% per 12 months within the 70s, it was simply 2.0% and a couple of.3%, respectively, within the 50s and 60s.

So whereas the actual returns have been spectacular within the Nineteen Fifties and fairly good within the Nineteen Sixties, they have been terrible within the Seventies.

You may by no means gauge the markets utilizing any single variable but when I needed to rank them when it comes to significance, inflation would get extra first place votes than rates of interest.

The inventory market has finished effectively up to now when rates of interest have been rising. However the inventory market has tended to carry out poorly when inflation is increased.1

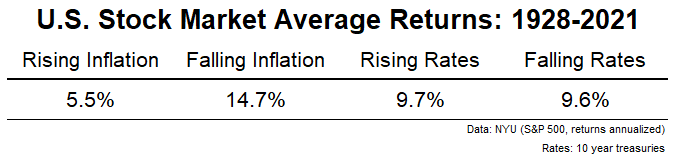

Utilizing information going again to 1928, I checked out how the inventory market performs in a given 12 months relying on rising/falling inflation and rising/falling rates of interest:

This can be a easy train however tells the story. The inventory market doesn’t do practically as effectively when inflation is rising and it does very well when inflation is falling (on common).

However in the case of rates of interest, there isn’t a lot of a discernible sample. I do know lots of people wish to consider falling rates of interest have been the only reason behind your complete bull market in shares from the early-Eighties however my rivalry could be disinflation was an even bigger catalyst.

Does this imply Dalio shall be confirmed improper?

I don’t know. Possibly rates of interest matter extra proper now as a result of traders received used to them being so low for thus lengthy.

However the larger danger to me isn’t rising charges, it’s excessive inflation sticking round quite a bit longer.

Michael and I talked in regards to the affect of excessive hurdle charges on the inventory market on this week’s reside taping of Animal Spirits:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Inflation Issues Extra For the Inventory Market Than Curiosity Charges

1Learn extra right here for some ideas on why the inventory market doesn’t like excessive inflation.

[ad_2]