[ad_1]

HDFC has launched 3 smart-beta (issue) ETFs.

- HDFC Nifty 100 High quality 30 ETF: Whereas I’ve not written a devoted put up on this index, I’ve in contrast the efficiency of a High quality index (albeit a unique one. Nifty 200 High quality 30 index) in lots of posts. I don’t anticipate the efficiency to be too completely different.

- HDFC Nifty 50 Worth 20 ETF (NV20): Have reviewed the efficiency of this index (Nifty 50 Worth 20) earlier than and the findings had been beneficial. You’ll be able to examine this index and the way it’s a mixture of high quality and worth components right here.

- HDFC Nifty Development Sectors 15 ETF: We’ve got by no means mentioned this index earlier than.

A High quality ETF. A Worth ETF. And a Development ETF.

I’ve mentioned each Nifty High quality index and Nifty 50 Worth 20 index within the following posts too.

How you can assemble the “Finest Portfolio” utilizing index funds and ETFs?

Efficiency comparability of all issue indices (High quality, Low Volatility, Momentum, Worth, Alpha)

I additionally reproduce a desk from the above posts. And you may see the efficiency of the High quality and NV20 indices is spectacular, at the very least in again assessments.

By the best way, many NV20 ETFs (ICICI, Nippon, Kotak) have been round for a over 5 years and the efficiency has been spectacular. So, we’re not simply speaking about again assessments. These funds have delivered within the stay information too.

Due to this fact, on this put up, allow us to give attention to HDFC Development Sectors 15 ETF. This can be a utterly new providing, and we’ve got no different index funds/ETF monitoring this index.

Allow us to see in case you ought to make investments on this ETF.

HDFC Development Sectors 15 ETF: How shares are chosen?

- Replicates the efficiency of Nifty Development Sectors 15 index.

- Because the title suggests, the index picks 15 “Development” shares. Nonetheless, methodology is sort of difficult.

- First, the “Development” sectors are chosen. Then, “Development” shares inside these sectors are chosen.

- To pick the “Development” Sectors, common yearly P/E and P/B of Nifty sectoral indices is in contrast in opposition to common yearly P/E and P/B of Nifty 50. You could find the complete record of Nifty Sectoral indices right here.

- These sectors with higher P/E and P/B are shortlisted. This Sector choice train is repeated each two years. Am unclear when that is due subsequent.

- From the chosen sectors, prime 50% shares (as per free float market cap) are shortlisted.

- The shares are then ranked by EPS development frequency (EPS stands for Earnings per share) and prime 15 shares are chosen. Unsure what EPS development frequency means. Weightage of any single inventory is capped at 15%.

- The shares’ rating is revisited, and index is rebalanced each 6 months.

- You’ll be able to learn the complete methodology right here.

Because the title suggests, the index tries to establish one of the best “Development” shares within the “Development” sectors. Additionally, notice the Sector rebalancing occurs each 2 years and shares rebalancing occurs each 6 months.

I copy the sectoral breakup and prime constituents for Nifty Development Sectors 15 index as on August 31, 2022. Supply: Factsheet

As on August 31,2022, the index includes solely 3 sectors. P/E and P/B are fairly excessive. Alongside anticipated traces.

Which funds/indices to match HDFC Nifty Development Sectors 15 ETF with?

Given the best way sectors and shares are picked for this index, this appears one more definition of momentum. As a substitute of counting on value information, it depends on elementary information.

First, choose sectors with excessive P/E and P/B. As soon as the sectors are picked, choose shares with the excessive EPF development frequency.

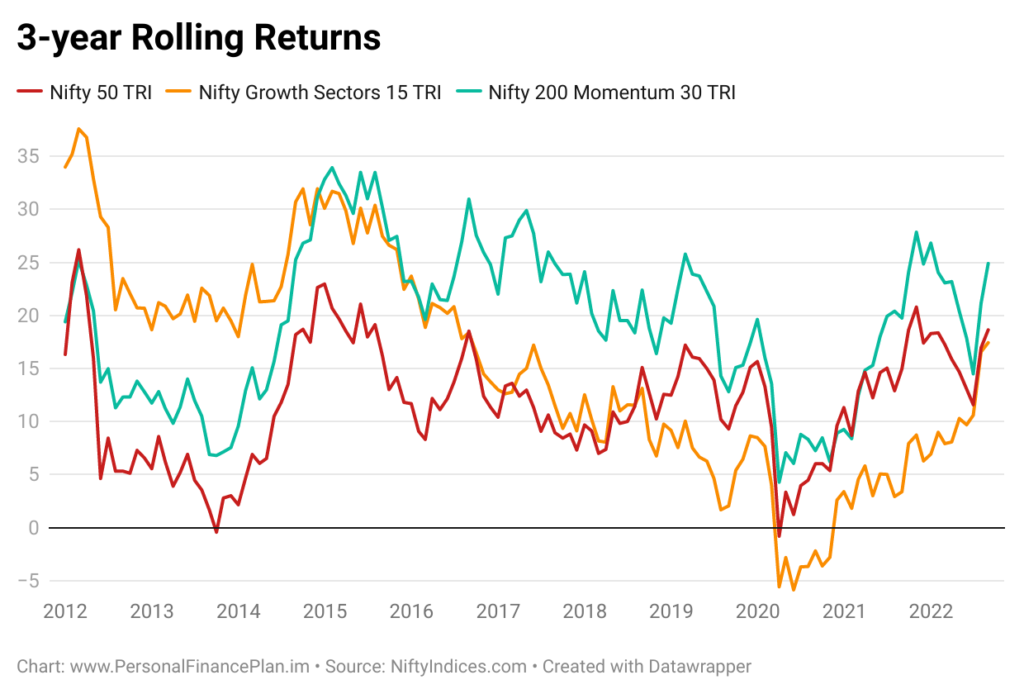

Due to this fact, whereas assessing the efficiency of this index (Nifty Development Sectors 15), it is smart to match the efficiency in opposition to Nifty 200 Momentum 30 index too.

On this put up, we’ll examine the efficiency of the next 3 indices.

- Nifty 50 TRI (No comparability is full with Nifty 50)

- Nifty Development Sectors 15 TRI

- Nifty 200 Momentum 30 TRI (since Nifty Development Sectors 15 appears to be one more definition of momentum)

Nifty Development Sectors 15 index was launched in 2014. Base Date: January 1, 2009

Nifty 200 Momentum 30 index was launched in 2020. Base date: April 1, 2005

HDFC Nifty Development Sectors 15 ETF: Efficiency Comparability

We examine the efficiency of the three indices since January 1, 2009, till August 31, 2022.

Nifty 50 CAGR: 15.21% p.a.

Nifty Development Sectors 15: 18.95% p.a.

Nifty 200 Momentum 30: 21.58% p.a.

The efficiency of all of the indices is spectacular. Momentum index is one of the best performer.

Nifty Development Sectors 15 beats Nifty 50 comfortably.

However that is only a snapshot in time. We have to analyze the consistency of returns too. Thus, we’ll have a look at calendar yr and rolling returns too.

As you possibly can see, Nifty Development Sectors 15 was one of the best performer in 4 out of first 5 years. From 2009 till 2013, the index was one of the best in all of the years anticipate 2012.

And when was the index launched? 2014

Due to this fact, you can not deny a component of curve-fitting to get one of the best outcomes.

From 2014 till 2021, the Nifty Development Sectors 15 finishes final in 6 out of 8 accomplished years. Beats Nifty 50 in just one out of 8 accomplished years.

Right here is the CAGR comparability for the three indices because the launch of Nifty Development Sectors 15. Whereas the launch date was Could 22, 2014. I contemplate the efficiency since Could 31, 2014.

Nifty 50: 13.0% p.a.

Nifty Development Sectors 15: 11.9% p.a.

Nifty 200 Momentum 30 index: 21.1% p.a.

Nifty Development Sectors 15 index has underperformed Nifty 50 in additional than 8 years since its launch. The index has solely outperformed Nifty in again assessments.

That is ok motive to STAY AWAY from HDFC Nifty Development Sectors 15 ETF.

HDFC Nifty Development Sectors 15 ETF: Rolling Returns

As talked about earlier, the relative efficiency of Nifty Development 15 ETF just isn’t spectacular since 2014.

HDFC Nifty Development Sectors 15: Most Drawdown and Rolling threat

The great efficiency is just earlier than the launch date (Could 2014).

On the rolling threat entrance, the Nifty Development Sectors 15 does effectively initially (even after Could 2014) however then unravels.

Nifty Development Sectors 15 Index: Efficiency Abstract

Whereas the efficiency of Nifty Development Sectors 15 index appears spectacular since inception (base date), the efficiency just isn’t good since its launch.

There isn’t a motive to take a position on this ETF.

HDFC Nifty Development Sectors 15 ETF Vs Nifty Momentum index funds and ETFs

Nifty Development Sectors appears one more definition of momentum. And depends on elementary information as an alternative of technical (value) information. Nonetheless, it fares badly in comparison with the standard definition of momentum that solely considers solely value information and volatility. Nifty 200 Momentum 30 picks momentum shares primarily based on value information.

Nifty 200 Momentum 30 index simply beats Nifty Development Sectors 15 index. Chances are you’ll argue that the Momentum index is even newer with launch date in 2020 and therefore its efficiency just isn’t reliable both. That’s proper however the definition of momentum is extra typical in Nifty 200 Momentum 30 index. And that provides extra confidence.

In fact, solely time will inform whether or not momentum investing (Momentum 30 index) will beat Nifty 50 over the long run.

Nonetheless, we do know that the momentum as outlined by Nifty Development Sectors 15 doesn’t appear to work. Frankly, it’s weird to see HDFC AMC launching such a product.

You will need to additionally have a look at diversification within the two portfolios. In Nifty Development Sectors 15 index (August 31, 2022), the cash is break up throughout simply 3 sectors. Distinction this with the breakup for Nifty 200 Momentum 30 index (as on August 31, 2022. As per factsheet).

So, Nifty 200 Momentum 30 index is extra diversified and has delivered a superior efficiency with a traditional definition of momentum.

Nifty Development Sectors 15 index is concentrated and performs poorly in comparison with Nifty 200 Momentum 30 index.

Why would you choose up Nifty Development Sectors 15 then?

I’m not suggesting that you have to put money into Nifty 200 Momentum 30 index funds or ETFs. You will need to make investments solely if in case you have conviction in momentum investing. And even with that conviction, be ready for prolonged durations of underperformance.

All I’m suggesting is: Don’t put money into HDFC Nifty Development Sectors 15 ETF.

Featured Picture Credit score: Unsplash

[ad_2]