[ad_1]

Goal and technique

Disciplined Progress Buyers pursue each long-term progress and modest present earnings at cheap danger. Roughly 65% of the portfolio is invested in shares and roughly 35% in bonds and money. The managers can progressively shift fairness publicity all the way down to about 55% or as much as about 70% if market situations warrant.

The managers make investments primarily in smaller US shares, at the moment outlined as these with market capitalizations between $1 billion and $15 billion. They “don’t mindlessly diversify throughout each market, sector, and asset class.” They give attention to well-managed firms and mid-sized progress shares. The portfolio is constructed. The core attributes of an excellent funding are “a sustainable aggressive benefit relative to trade friends, long-term superior return on capital coupled with the monetary capability to satisfy cheap progress targets.”

The fund invests in investment-grade bonds. The weighted period is 5-10 years, however with the fastened earnings sleeve, specifically, the managers enable that their course of “has each ‘top-down’ (together with period/ maturity positioning, yield curve danger, and sector/high quality danger) and ‘bottom-up’ (together with credit score analysis, quantitative evaluation, and buying and selling) parts.” In consequence, they could discover trigger to spend money on longer- or shorter-dated securities now and again.

The present portfolio holds 44 shares. By Morningstar’s calculation, 27% qualify as micro-to-small caps, 25% as mid-caps, and 19% as massive caps. They personal no mega-cap shares, which occupy over 30% of their friends’ portfolios.

Adviser

Disciplined Progress Buyers, headquartered in Minneapolis, was based in 1997. It’s primarily an institutional funding supervisor that gives funding administration providers to pension and profit-sharing plans, firms and different enterprise and authorities entities, charitable organizations together with foundations and different non-profit entities, and choose high-net-worth people. The Disciplined Progress Investor Fund is their try to offer an institutional-quality portfolio accessible to common of us. The agency managed $5.4 billion for over 110 shoppers as of 12/31/21. They advise two restricted partnerships and this one fund.

Managers

Fred Martin, Rob Nicoski, Nick Hansen, and Jason Lima.

Mr. Martin based Disciplined Progress Buyers in 1997 and has managed the fund since its inception in 2011. He’s a Navy veteran who began his investing profession at Northwestern Nationwide Financial institution. Mr. Nicoski joined DGI in 2003. Previous to becoming a member of DGI, he was a co-manager on a small cap mutual fund at US Financial institution, an analyst at Piper Jaffray, and a financial institution examiner for Minneapolis Federal Reserve. Nick Hansen joined DGI in 2006 as an analyst out of the MBA program at St. Thomas (my son’s alma mater, so “go Tommies!”). Previous to that, he had been within the graphic design/promoting world working in 3D animation (he’s a pc science man) and has additionally been on the fund since inception. Mr. Lima, a Navy veteran, joined DGI in 2011 and the fund in 2022. His undergrad diploma is from MIT in Electrical Engineering and Laptop Science (a mixed program), which was adopted by an MBA from Sales space College of Enterprise in Chicago. The entire managers are CFA Charterholders. Mr. Nicoski has earned his CPA.

Technique capability and closure

Mr. Martin intends to shut the fund by the point it reaches $1 billion AUM. “We’re,” he admirably famous, “barely loopy about undersizing our mandates. We’ll do what we have to, to guard the flexibility of the fund to carry out.”

Administration’s stake within the fund

Mr. Martin has over $1,000,000 within the fund. Mr. Nicoski is within the $500,000-$1,000,000 bracket, whereas Mr. Hansen is reported to have an entry-level place of $10,000-50,000. The latest member of the workforce doesn’t but seem within the official paperwork and, as such, has no report on share possession. That mentioned, Mr. Martin stories that each worker at DGI is invested within the fund.

Opening date

August 12, 2011, however the underlying technique, accessible by individually managed accounts, dates to February 28, 1997

Minimal funding

$10,000 for a one-time buy or $100 for accounts established with an automated investing plan and the intention of constructing to $10,000. The fund just isn’t accessible by third-party distributors corresponding to Schwab.

Expense ratio

0.78% on property underneath administration of about $340 million. In an interview, Mr. Martin declared that “too excessive” and hopes to whittle it down as property develop.

Feedback

Disciplined Progress Buyers is without doubt one of the best-performing balanced funds in existence. It’s additionally one of the distinctive. That distinctiveness makes it attention-grabbing and helpful, nevertheless it additionally renders treacherous comparisons with its nominal friends.

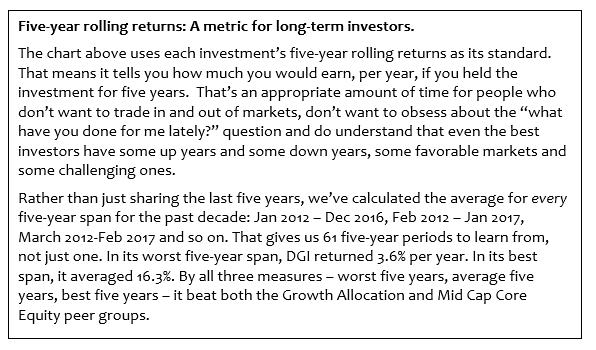

Let’s begin with the “the perfect” declare. Over the previous 10 years, Disciplined Progress Buyers completed 5th of 190 progress allocation funds in complete returns with an annual return of 9.9%. Its annual return over the typical five-year interval, its “common annual return over 61 rolling five-year durations,”10.5%, can also be 5th of 190.

“Most distinctive” displays its dedication to smaller shares. The typical market cap for Disciplined Progress is $11 billion, by Morningstar’s calculation. Its common peer sits at $63 billion. DGI invests 27% of its portfolio in micro-to-small cap shares, its friends place 4% there. By each measures, that’s a seven-to-one distinction between DGI and the group. Collectively, micro-to-mid cap shares comprise 52% of the full portfolio the place their friends make investments underneath 20%. The typical market cap for shares within the DGI portfolio is almost the identical because the market cap of Lipper’s mid-cap core fairness fund group.

Equally, the fund’s sector weights are utterly unbiased of its friends: of 11 commonplace sectors (corresponding to tech or financials), DGI has peer-like weights in solely two: power and industrials. They don’t have any present publicity to 3 sectors (actual property, utilities, and primary supplies) and differ in some sectors (e.g., financials) by 10:1 in comparison with their friends.

That’s a large distinction with critical implications for the reliability of peer group comparisons. DGI is extra unstable than virtually all of its Progress Allocation friends however much less unstable and — measured by its common five-year efficiency – extra worthwhile than a pure mid-cap fairness portfolio.

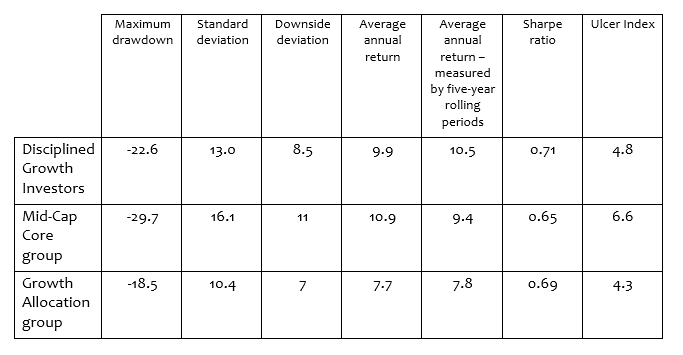

10-year risk-return metrics

How do you learn that?

In our three danger measures – most drawdown, commonplace deviation (or “day-to-day volatility”), and draw back (or “unhealthy”) volatility – DGI is a little more unstable than its massive cap-heavy allocation funds and considerably much less unstable than a peer mid-cap fairness fund.

In our two return measures – annual returns over the previous decade and annual returns measured by the expertise of somebody keen to carry the fund for 5 years – have DGI incomes equity-like returns of 10% and outperforming each pure fairness and allocation funds primarily based on its efficiency over a sequence of 60 five-year rolling durations. That’s essential as a result of it captures the doubtless returns of a long-term investor, the group that any accountable supervisor cares most about.

The risk-return ratios – the Sharpe ratio and the Ulcer Index, which measures the depth and period of a fund’s drawdowns (named for the commentary that investments that drop so much and keep down a very long time give us ulcers) – present DGI superior to an all-equity portfolio and greater than aggressive with a progress allocation one.

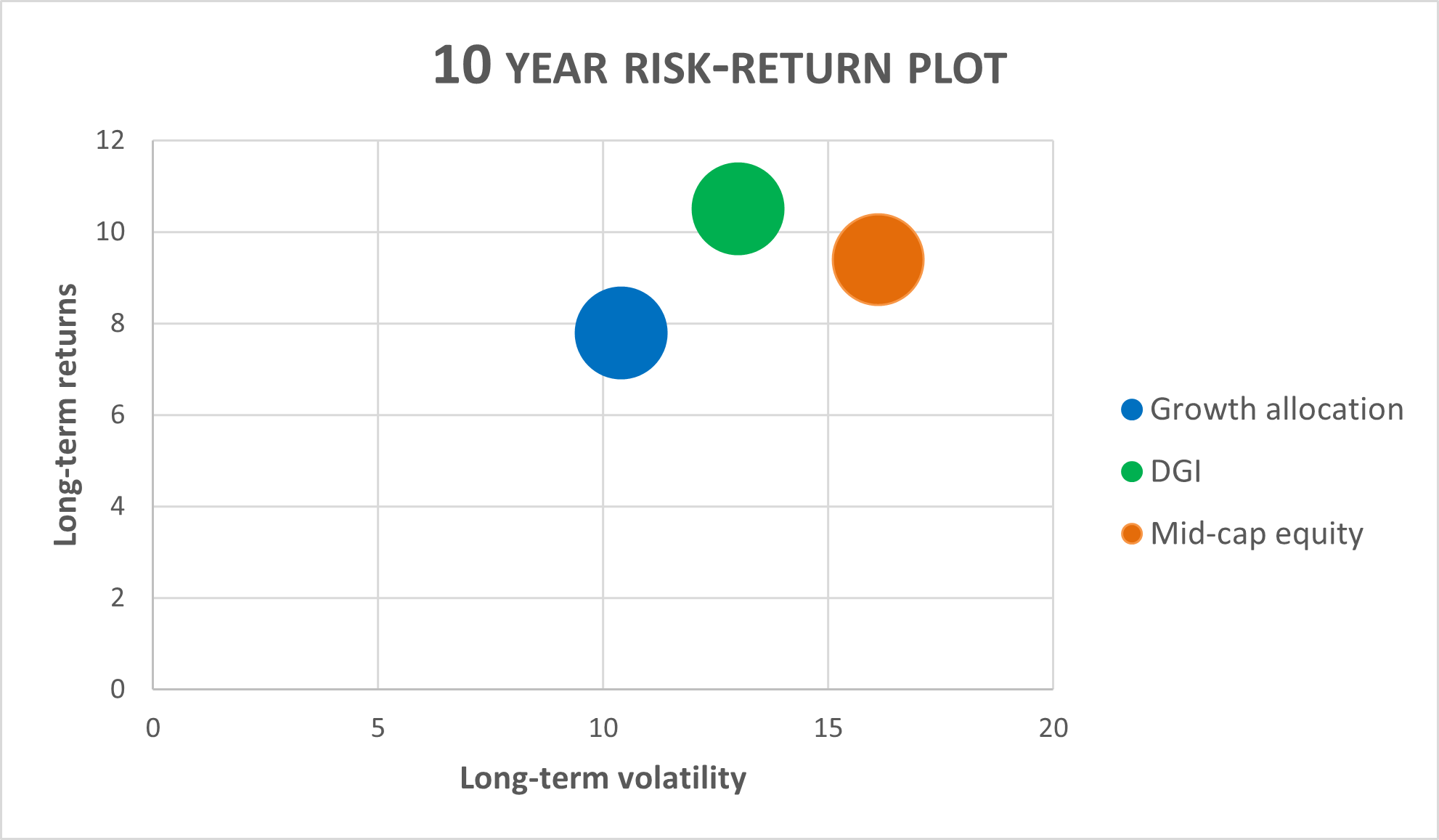

Right here’s the simplified snapshot of that very same knowledge.

10-YEAR RISK-RETURN PLOT

10-year commonplace deviation / APR primarily based on a five-year rolling common

That regular outperformance is pushed by two components.

1. the managers are value-conscious, which makes the portfolio risk-conscious.

The core self-discipline begins with a “very granular” forecast of the seven-year progress prospects of each potential portfolio firm. They’ve used, with refinements, the identical self-discipline for 25 years. If a inventory doesn’t venture returns of at the least 12% yearly for the subsequent seven years, they’re out of the dialogue. That’s referred to as their hurdle price, and it accounts for the prospects of the corporate and in addition the value of the corporate’s inventory.

Mr. Martin notes that:

We lose cash if our forecasts are flawed or we overpay. We’ve got one of many most interesting long-term data wherever as a result of we’re singularly centered on these two issues … up to now 18-24 months, the shares of high-growth firms have been promoting at costs effectively in extra of the longer term worth of the underlying firms … [in a bear market] the previous excessive fliers endure everlasting lack of capital whereas appropriately priced shares endure solely non permanent markdowns.

Traditionally, DGI’s valuation-sensitive method has paid off handsomely “after the bubble has popped.” By their calculation, their shares outperformed the Russell Mid-Cap Progress Index by 4300 foundation factors over the 5 years following the Tech Bubble in 2000 and by 4500 bps within the 5 years following the World Monetary Disaster in 2008. Cumulatively, since its 1997 inception, its inventory portfolio has turned $100 into $1,583 (as of June 2022), whereas the identical funding within the all-stock Russell Mic Cap Progress Index would have returned on $811.

Anticipating liquidity restrictions, the managers “spent final yr de-risking the portfolio, which triggered lots of turnover and excessive capital good points taxes, however we had to answer overvaluation.” The following bear market led to “wonderful values” amongst portfolio shares, with our shares exhibiting anticipated returns comfortably above our hurdle charges. Our portfolios are exhibiting the best anticipated returns since 2008 …”

An investor’s greatest danger, he argues, “is a protracted interval of low returns,” and he’s fairly snug that DGI is positioned to keep away from that.

2. the managers need to be in your everlasting portfolio.

By its individually managed accounts, DGI presents all-equity portfolios, however Mr. Martin acknowledges that pure fairness is just too unstable to be a cushty everlasting core holding. Including 30% money and bonds – corporates, greater than Treasuries simply now – they’re in a position to dial again volatility, add a little bit of earnings and never sacrifice long-term returns.

“We want,” Mr. Martin says, “to be applicable as 100% of a 70-year-old’s portfolio” as a lot as being a cushty core for a 30-year-old’s.

Backside Line

We may be within the midst of the most recent retelling of an previous story: investor mania, authorities missteps, froth, and FOMO, adopted by a painful comeuppance and the start of a brand new monetary atmosphere. The inventory market has slammed right into a brick wall 30 instances up to now century; it’s uncommon that one market’s darlings survive to be the subsequent market’s darlings. That implies that prudent traders may look past the FAANGs and their speculative siblings through the turbulence in the present day and the brand new market rising within the years forward.

Mr. Martin and his colleagues have navigated their portfolios by durations of market insanity, collapse, and reset in each 2000 and 2008. Affected person traders prospered in each circumstances. Over the last decade of the mutual fund’s existence, it’s posted returns almost the very high of each its Morningstar and Lipper peer teams. That efficiency appears not to be an aberration. Sticking to their self-discipline – shopping for smaller shares positioned to develop, promoting them when prospects dim or costs develop into unjustifiable – appears to work.

Buyers who perceive that the upper short-run volatility may be a obligatory and bearable worth for larger long-term returns ought so as to add Disciplined Progress Buyers to their due diligence listing.

Fund web site

Disciplined Progress Buyers Fund. Please watch out. Disciplined Progress Buyers is a balanced fund, they usually do check with themselves as “DGI.” They’re not DGI Balanced Fund, which is obtainable by the Oriental Belief. Looking “DGI” at Morningstar unfailingly takes you to that different fund. DGI Balanced has nothing to do with this fund however may seem larger within the search outcomes.

Fairly individually, it’s regrettable for a direct-sold fund to have just a few hundred phrases of content material complete on its web site. Inexplicably, a lot of the core content material – prospectus, annual report, and account varieties – is hidden underneath the tab labeled “Geeks + Legal professionals.”

[ad_2]