[ad_1]

Executives at publicly traded US firms have gotten more and more nervous in regards to the spectre of an additional escalation of tensions over Taiwan, a significant provider of essential parts like semiconductors.

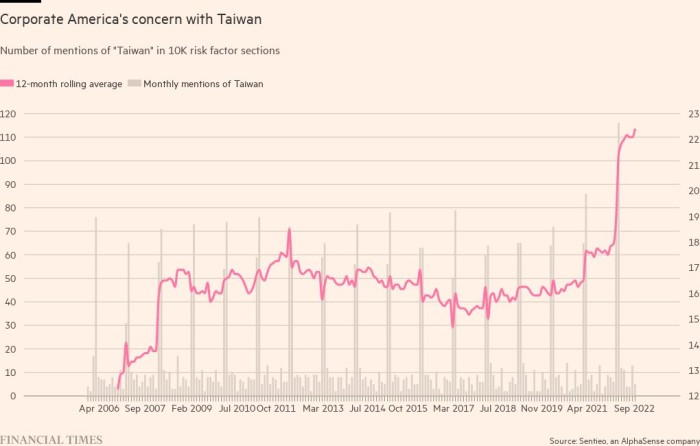

The variety of annual regulatory filings citing Taiwan as a threat issue has risen considerably over the previous 12 months, in response to Monetary Occasions calculations primarily based on Sentieo information. In March, a well-liked time for releasing so-called “10-k” experiences, 116 firms talked about Taiwan as a threat to their enterprise, and the rolling 12-month common this month reached its highest stage in not less than 16 years.

Know-how firms characterize the sector most involved, with these within the semiconductor business elevating the loudest alarm. It is because Taiwan, which is the largest producer of probably the most superior chips, is quickly turning into one of many world’s most harmful geopolitical flashpoints. The worry is that within the occasion of a battle with China, US corporations might be unable to get the microchips wanted to make smartphones, electrical vehicles, new weapons, computer systems industrial machines, and even medical units. Healthcare is the second most-concerned sector.

“A ‘de facto’ blockade by Mainland China’s common navy workout routines would create bottlenecks in fast-growing sectors depending on semiconductors, akin to excessive efficiency computing, web of issues, information centres and electrical automobiles,” Alicia García-Herrero, chief Asia-Pacific economist at French financial institution Natixis, mentioned.

In an indication of the possibly wide-ranging company results, a clutch of chief executives at large US banks informed Congress this week that they might adjust to any US authorities demand to drag out of China if Beijing have been to assault Taiwan. The remarks got here simply days after US president Joe Biden mentioned the US would defend Taiwan from a Chinese language assault.

The median US firm had solely had 5 days’ price of chip inventories in 2021, down from 40 in 2019, in response to a examine the Division of Commerce.

In the beginning of August, Biden signed the Chips Act, which can present $280bn in funding to prop up and kick-start home semiconductor manufacturing and analysis.

“The US will put extra strain on key suppliers to ban exports to China and develop manufacturing in its personal market with industrial coverage instruments, such because the Chips Act and a push for friend-shoring,” García-Herrero mentioned.

[ad_2]