[ad_1]

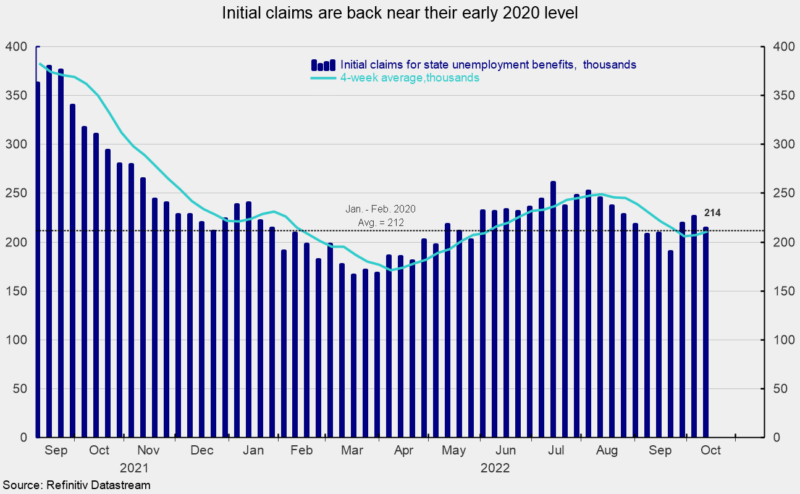

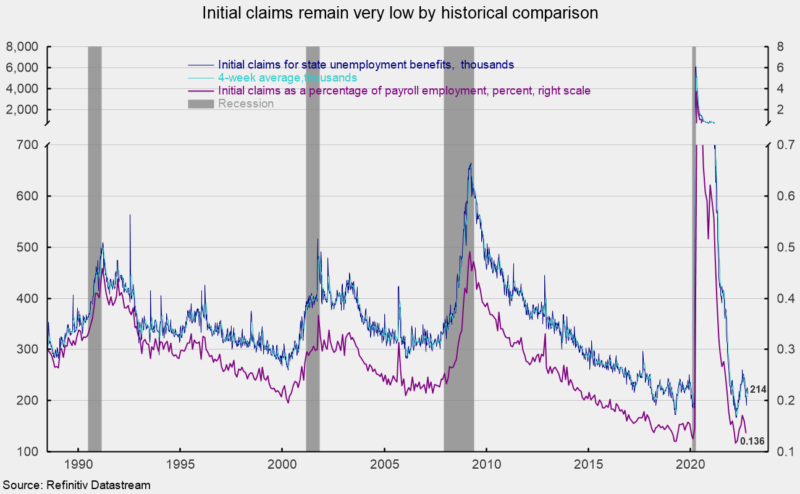

Preliminary claims for normal state unemployment insurance coverage fell by 12,000 for the week ending October 15th, coming in at 214,000. The earlier week’s 226,000 was revised down from the preliminary tally of 228,000 (see first chart). Claims have fallen for seven of the final ten weeks. When measured as a proportion of nonfarm payrolls, claims got here in at 0.136 p.c for September, down from 0.160 in August however above the document low of 0.117 in March. General, the extent of weekly preliminary claims for unemployment insurance coverage stays very low by historic comparability (see second chart).

The four-week common rose to 212,250, up 1,250 from the prior week. After exhibiting an upward pattern since a low in early April, the four-week common peaked in early August and trended decrease by way of the tip of September however has risen barely because the low. General, the info proceed to recommend a good labor market. Nonetheless, continued elevated charges of value will increase, an aggressive Fed tightening cycle, and fallout from the Russian invasion of Ukraine stay dangers to the financial outlook.

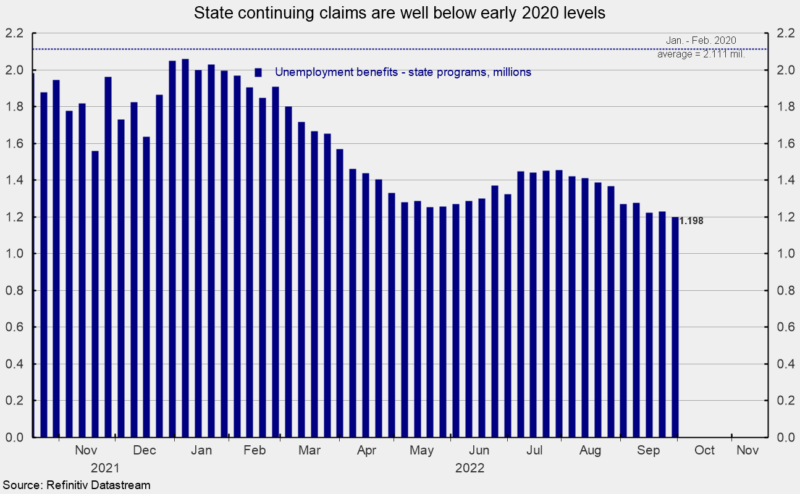

The variety of ongoing claims for state unemployment packages totaled 1.198 million for the week ending October 1st, a drop of 31,728 from the prior week (see third chart). State persevering with claims had been trending increased from mid-Might by way of the tip of July however are actually trending decrease over the previous few weeks (see third chart).

The most recent outcomes for the mixed Federal and state packages put the overall variety of folks claiming advantages in all unemployment packages at 1.224 million for the week ended October 1st, a lower of 30,879 from the prior week. The most recent result’s the thirty-fourth week in a row under 2 million and the bottom of the post-lockdown-recession restoration.

Whereas the general low stage of preliminary claims suggests the labor market stays stable, a pointy drop within the variety of open jobs raises some concern. The tight labor market is a vital part of the economic system, offering help for client spending. Nonetheless, persistently elevated charges of value will increase already weigh on client attitudes, and if shoppers lose confidence within the labor market, they might considerably scale back spending. The outlook stays extremely unsure.

[ad_2]